Yes, you can file an insurance claim in Florida without a police report, but it may weaken your case. Florida law requires reports for crashes with injuries, DUI, or over $500 in damages. You have 10 days to self-report a crash via Florida Highway Safety and Motor Vehicles (FLHSMV)

If you got into a car accident in Florida without filing a police report you should check this guide. We’ll cover what happens if you don’t report, when it’s required, what the 14-day rule means, and how to protect your rights under Florida’s no-fault insurance laws.

Can You File an Insurance Claim in Florida Without a Police Report?

In Florida, a police report is not always required to file an insurance claim, especially for minor accidents. That said, going without one can put you at a disadvantage when it’s time to prove your case.

A police report offers structure. It timestamps the event, lists all involved parties, and may include witness accounts or diagrams. Without it, you’re relying entirely on your own word, and that often gives the other driver more room to deny fault or shift liability.

If you decide not to call law enforcement, know this: you’re still responsible for reporting the crash under certain conditions. By law, a police report becomes mandatory if the accident:

- Involves injury or death

- Causes property damage exceeding $500

- Requires a vehicle to be towed from the scene

- Occurs due to drug or alcohol impairment

- Is a hit-and-run

Even if none of those apply, filing a report, either with a responding officer or through the state’s self-reporting system, can strengthen your claim. Especially if medical bills or future compensation become part of the equation.

What Happens If You Don’t File a Police Report

If the crash falls within Florida’s legal reporting thresholds, you have 10 days to file a report. This can be done online or by submitting a Driver Report of Traffic Crash by email.

Skipping this step doesn’t just risk a fine. It can complicate your insurance claim and introduce new legal issues down the road. Insurance companies often interpret a lack of documentation as a red flag, especially if liability is unclear or injuries emerge later.

Even if you weren’t at fault, failing to report a crash may give the impression that you have something to hide, whether that’s intoxication, driving without a valid license, or simply poor judgment. That perception can reduce the credibility of your version of events.

Be sure to keep a copy for your records. If your case ever escalates, whether to small claims or civil court, this documentation could be what keeps your claim afloat.

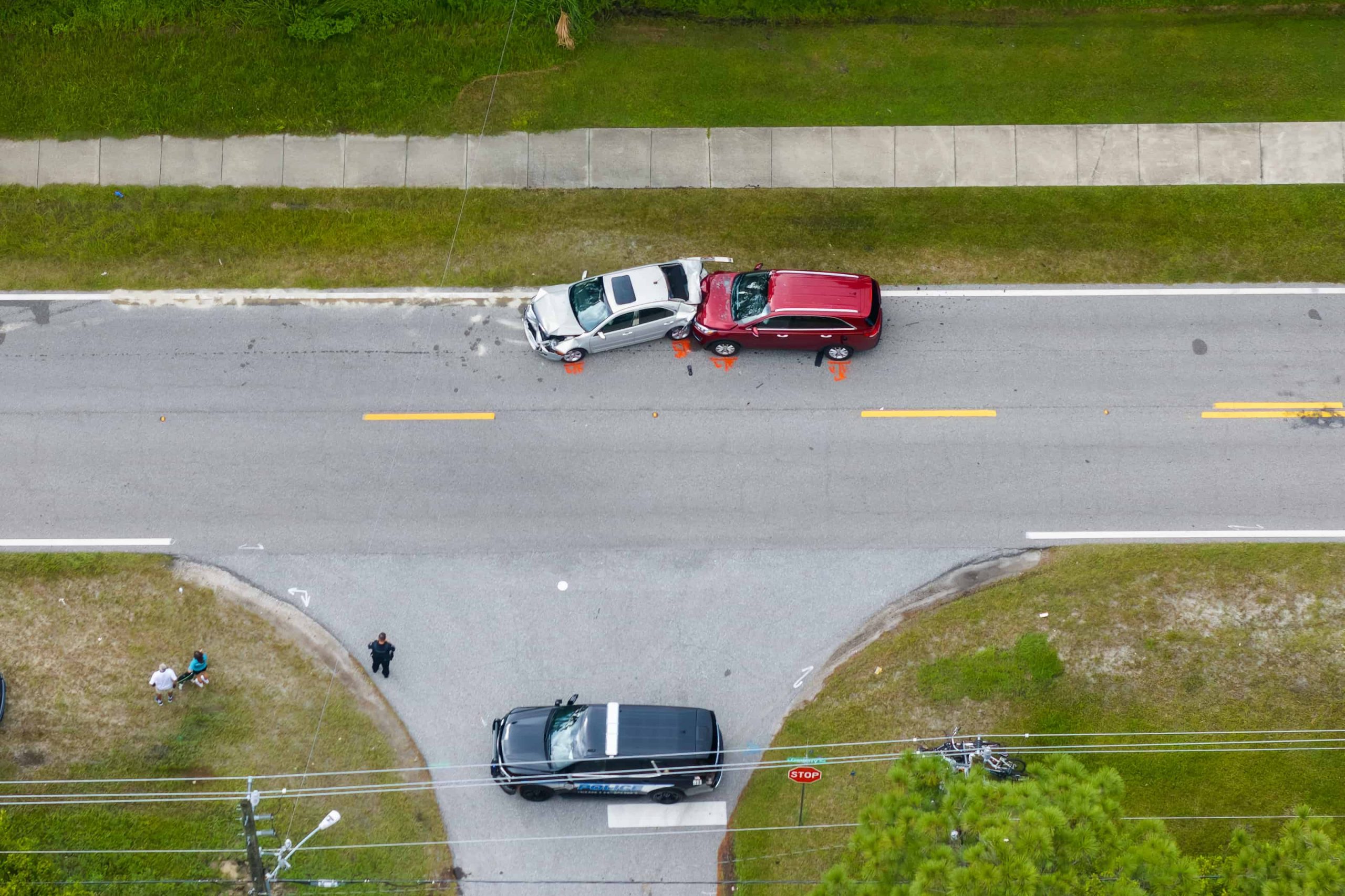

When Police Don’t Show Up

Many drivers across Florida have reported situations where law enforcement never arrived at the scene of a minor crash. In places like Orlando and Orange County, police departments often won’t dispatch officers unless there’s a visible injury, a fatality, or a serious traffic obstruction.

This leaves drivers on their own, sometimes for hours. And when the other party becomes aggressive, changes their story, or pressures you into handling the situation off the books, that vulnerability can turn into legal and financial trouble.

Here’s how to protect yourself:

- Take detailed photos and videos of both vehicles, the surrounding scene, and road conditions.

- Document names, contact numbers, and insurance information.

- If a witness is present, get their statement and contact info.

- Use dashcam footage if available. While some insurers may downplay its value without a police officer reviewing it, it can still serve as vital evidence.

When police don’t respond and a report isn’t filed, a lot of uncertainty follows, especially when it comes to dealing with the insurance company or navigating legal rights.

“Will My Insurer Reject My Claim Without A Report?”

Possibly. Some insurance companies use the absence of a police report as a reason to delay, devalue, or deny your claim, especially when liability is in question or injuries appear later.

“I Paid The Other Driver $75. Will That Hurt Me?”

It might. Without a signed release of liability, even a small cash payment can be interpreted as an admission of fault. If the other party later files a claim, you may be seen as having accepted blame.

“I Felt Unsafe Waiting, What Should I Do?”

Your safety comes first. If the other driver is aggressive or you feel at risk, leave the scene after documenting as much as possible. File a crash report online as soon as you’re in a secure place.

“The Police Never Filed The Report. Now What?”

You can follow up with the agency, but don’t wait too long. If no officer officially documented the accident, file your own report using Florida’s crash self-reporting system and keep copies for your insurance claim.

When your crash goes undocumented, these scenarios become more complex and stressful. That’s where having professional guidance, legal, medical, or both, can keep you from falling through the cracks.

What If the Crash Wasn’t Your Fault

Legally, you’re not required to file a report in every situation. But if you weren’t at fault, a police report can be one of your strongest tools in defending that position.

Police reports serve as an objective account. They document the scene, note possible violations of traffic law, and capture initial statements, often before either party has had time to reframe the story. This can be critical if your personal injury claim or property damage case is later challenged.

A report can help you to demonstrate the other driver’s negligence, strengthen your personal injury claim with time-stamped details, and clarify fault if conflicting stories emerge.

While dashcams can supplement your claim, some insurance companies have reportedly rejected footage unless it was reviewed or referenced by an officer. Without a formal report, you may face delays, lower settlement offers, or outright denial of your insurance claim.

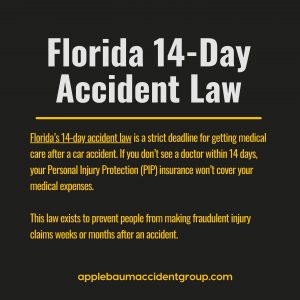

Be Aware Of Florida’s 14-Day Rule

Under Florida’s Accident Law, there is a firm 14-day window following a motor vehicle accident in which you must seek medical attention to be eligible for Personal Injury Protection (PIP) benefits.

These benefits are the foundation of Florida’s no-fault system. If you don’t get medical care within 14 days, your insurance company can legally reject your claim, even if the accident wasn’t your fault.

Here’s what you need to know:

- The 14-day clock starts from the date of the accident, not when you notice pain.

- You don’t need to go to the ER. A visit to a licensed medical professional, doctor, chiropractor, or clinic, satisfies the rule.

- If your injuries meet the criteria for an Emergency Medical Condition (EMC), you may receive extended benefits.

Too many victims lose access to compensation because they “felt fine” and didn’t seek treatment until symptoms appeared days or weeks later. The law doesn’t account for delayed onset, only the calendar does.

If you’ve been in a crash, even a minor one, document it and get checked out. It’s not just about health, it’s about protecting your legal rights.

How No-Fault Coverage Works

Florida follows a no-fault insurance model. This means your own insurance company is responsible for covering certain costs, regardless of who caused the accident. The foundation of this system is Personal Injury Protection (PIP) coverage.

Your PIP will typically pay for:

- Up to 80% of medical bills

- Up to 60% of lost income

This system is designed to reduce litigation over minor accidents, but it has limitations. If your medical expenses exceed your PIP limits or you suffer permanent or serious injuries, you may step outside the no-fault system and file a claim against the at-fault driver.

In these situations, having a police report becomes far more than just helpful, it can make or break your case. It offers documentation of negligence, confirms liability, and can support a larger personal injury claim that includes pain and suffering, lost earning capacity, or other economic losses.

Learn more about it here👉 What Is The Maximum Pip Coverage In Florida

When You Should Absolutely Contact a Lawyer

While many minor collisions can be resolved through self-reporting and basic insurance claims, there are times when legal help isn’t just helpful, it’s necessary.

Reach out to a car accident lawyer if any of the following apply:

- You or another party has suffered serious injuries or the accident resulted in death

- The other driver is denying fault or altering their version of events

- Someone is urging you to handle the situation off the record, with cash or informal agreements

- You missed Florida’s 14-day PIP window but are still in need of medical attention

- You’re unsure whether your insurance company is handling your claim fairly, or at all

In these situations, waiting too long to seek legal support could affect your right to compensation, especially when documentation is already limited by the absence of a police report.

Your Legal Safety Net

Every accident, no matter how minor, sets off a chain of consequences. A missing police report can complicate everything from personal injury claims to insurance reimbursements, but it doesn’t have to derail your case entirely, and you don’t have to navigate it alone.

Applebaum Accident Group connects you with trusted attorneys who understand what your case is worth, and how to make sure you don’t settle for less.

📞 855-225-5728 | Request Your Free Consultation Now

With Applebaum Accident Group, you gain access to Florida’s top legal and medical networks, without the stress or confusion. We help you move forward with confidence, clarity, and the support you need.