To calculate lost wages after a Florida car accident, multiply the hours or days missed by your hourly or daily income. Include lost bonuses, commissions, PTO used, and future earning capacity. Documentation from doctors and employers is required to file a claim.

In Florida, drivers injured in a car accident are typically covered by personal injury protection (PIP), which pays up to 60% of lost income, but only within a $10,000 cap that also includes medical expenses.

For many accident victims, that’s not nearly enough to cover their actual losses. Missed paychecks, used vacation days, tips, commissions, and future income potential often go uncompensated simply because they aren’t properly documented or pursued.

This guide walks through, step by step, how to calculate and claim every dollar you’re owed after a Florida car crash.

Whether you’re a salaried employee, gig worker, or business owner, you’ll learn how to gather the right paperwork, prove your case, and navigate insurance hurdles, so that you can recover not just your wages, but your footing.

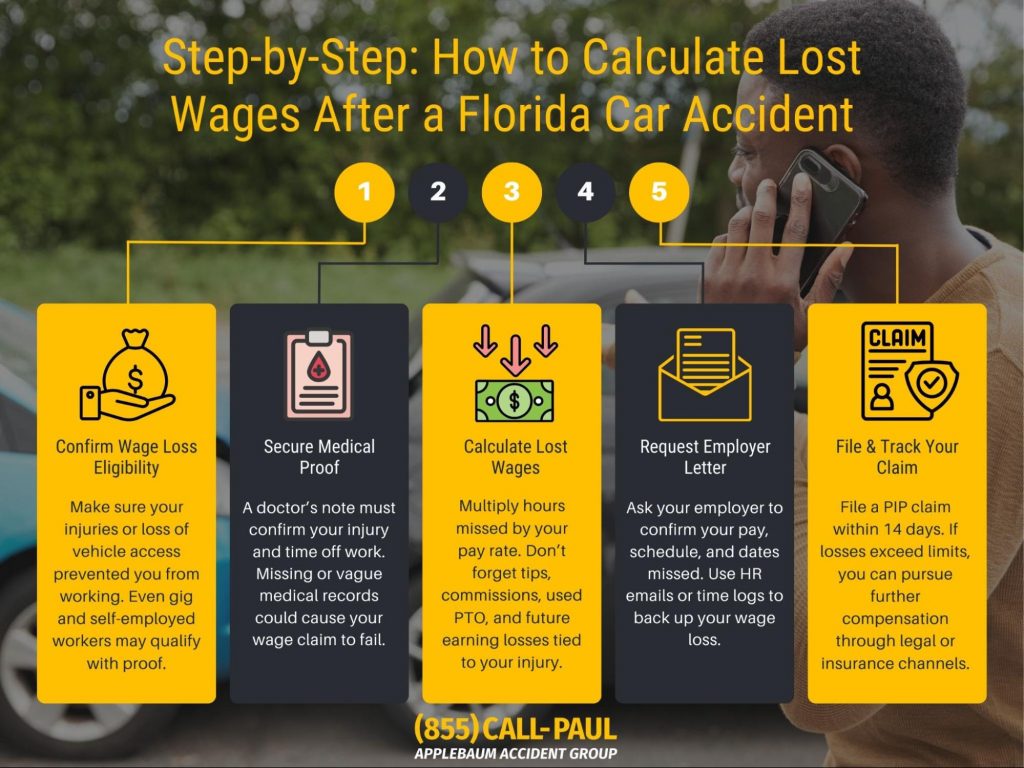

Step-by-Step: How to Calculate Lost Wages After a Florida Car Accident

Step 1: Confirm You’re Eligible for Wage Recovery

To claim lost wages in Florida, you must prove that your injuries, or lack of access to your vehicle, have directly prevented you from working.

This applies whether you’re a full-time employee, part-time worker, or someone who depends on their vehicle for income, such as a rideshare or delivery driver.

Florida’s no-fault insurance system offers initial coverage under Personal Injury Protection (PIP), which pays 60% of lost income, capped at $10,000 total for both wages and medical bills. If your total losses exceed that, or if your injuries meet Florida’s serious injury threshold, you may have the right to pursue further compensation through the at-fault driver’s insurance or by filing a personal injury claim.

Even if you’re self-employed or work in the gig economy, you’re not excluded.

With proper documentation, such as invoices, tax returns, or ride logs, you may still qualify for wage replacement under Florida law.

Step 2: Gather Medical Evidence

Before you can calculate or claim lost wages, you’ll need medical documentation showing that your injury made it medically necessary to miss work. This is where many injury claims fall apart, not because the injuries weren’t real, but because they weren’t recorded correctly or completely.

You should obtain a doctor’s note or disability slip that includes:

- Your medical diagnosis

- Specific physical limitations

- The timeframe during which you were unable to work

- An estimated recovery timeline

Inconsistent or missing medical records can weaken your claim.

Failing to follow through on prescribed treatment, whether physical therapy, follow-ups, or medication, can lead an insurance adjuster to argue that your condition didn’t warrant missed work at all.

Step 3: Calculate Your Actual Wage Loss

The formula for calculating your lost wages depends on how you earn your income. Here’s how to approach each situation:

- Hourly Workers: Multiply your hourly wage by the number of hours you missed.

Example: $20/hour × 40 hours missed = $800 - Salaried Employees: Divide your annual salary by 2,080 (standard work hours per year), then multiply by hours missed.

Example: $52,000 ÷ 2,080 = $25/hour. $25 × 40 hours = $1,000 - Gig Workers (e.g., Uber, DoorDash): Use your average weekly earnings from the past 12–24 months. Submit app payout summaries, trip logs, and payment histories to prove this income.

- Self-Employed Individuals: Prepare tax returns, invoices, business contracts, and bank records. A CPA or economic expert may be necessary to estimate your income loss accurately.

Also include:

- Lost commissions, tips, or overtime

- PTO or vacation days used during recovery

- Missed raises or bonuses tied to performance

- Any reduction in future earning potential due to long-term injury

Step 4: Document Employer Verification

You’ll also need your employer’s help to substantiate your income and missed time. Ask for a written letter or employment verification form that includes:

- Job title and responsibilities

- Pay structure (hourly/salary)

- Average hours per week

- Dates missed due to the accident

- Any promotions or upcoming raises that were delayed or lost

Support your claim further with attendance logs, HR emails, or time-tracking software reports if available.

Step 5: Submit Your Claim

To start, file your PIP claim with your auto insurance provider within 14 days of the accident. This is required under Florida law and is non-negotiable. If your medical or wage losses exceed your policy limits, you may:

- File a third-party claim with the at-fault driver’s insurer

- Tap into your Uninsured/Underinsured Motorist (UM/UIM) coverage

- File a personal injury lawsuit to recover the remaining compensation

Keep thorough records of everything: insurance forms, medical documents, employer letters, and all communications with insurance adjusters. Consistency and follow-through are key to preserving the value of your claim.

What You’re Entitled To After a Florida Car Accident

What’s Covered Under PIP

Florida’s PIP coverage is limited but automatic. Regardless of fault, you are eligible for:

- 60% of your gross lost wages

- Medical care costs (up to the combined $10,000 cap)

- Reimbursement for PTO or vacation days used for recovery, since they represent economic losses

However, once this cap is reached, or if your injuries are deemed severe, you may be eligible to go beyond PIP.

When You Can Go Beyond PIP

You can pursue additional compensation if:

- Your injury results in permanent loss of a bodily function, significant scarring, or long-term disability

- The at-fault driver carries bodily injury liability insurance

- You have underinsured motorist coverage on your policy

In these cases, you may be entitled to broader economic damages (like extended wage loss) and non-economic damages (like pain and suffering, emotional distress, or mental anguish).

These additional claims typically require legal guidance and a more thorough documentation process, but they can dramatically increase the total settlement value.

FAQs About Florida Lost Wage Claims

What is the typical car accident settlement amount in Florida?

Most cases resolved through Personal Injury Protection (PIP) alone cap out under $10,000, because that’s the combined limit for both medical care and lost wages.

However, if your injuries are severe, you may qualify to file a personal injury claim against the at-fault driver. With legal action, settlements can range from $15,000 to $100,000 or more, depending on the nature of the injury, long-term complications, and lost income. In high-impact cases, lost wages are often one of the largest components of the settlement value.

Read this article to get the full picture: What Are The Average Personal Injury Settlement Amounts?

I wasn’t injured, but my car’s in the shop. Can I still claim lost wages?

Yes. If your ability to earn income depends on access to a working vehicle, as is the case for Uber drivers, construction workers, or mobile sales professionals, you can potentially claim economic losses, even without a medical injury. The key is proving your loss of use directly impacted your ability to earn.

Uber told me I was covered. My insurer disagrees. Who’s right?

It depends on when the crash happened. Uber’s commercial policy only applies while you’re actively engaged in a ride. If the app was closed or you were in between rides, your personal policy may not cover you either, especially if you didn’t disclose commercial use. This gray area may require guidance from an attorney familiar with rideshare claims and coverage exclusions.

Neither insurer is helping me. What now?

If both insurers are pointing fingers, you don’t need to give up. Many injury victims resolve these disputes by:

- Sending a formal demand letter to the at-fault insurer

- Taking the case to small claims court, especially for modest wage claims

- Documenting every step to show your attempt to mitigate losses and follow procedure

While an attorney may not always take small-value claims, a clear paper trail and well-prepared case can still produce results.

Can I claim lost wages if I used PTO to recover?

Yes. Vacation days and sick leave are financial assets. If you had to use them because of an injury, they represent a loss just like any missed paycheck. That means you can include their value in your injury claim, even if your paycheck never skipped a beat.

Tips to Maximize Your Lost Wage Recovery

- Keep a written journal documenting missed work, symptoms, doctor visits, and recovery progress

- Track future losses, especially if your ability to return to full work is delayed

- Consult a financial expert for complex income streams or business interruption losses

- Save all correspondence, emails with insurers, HR letters, receipts, appointment logs

- Investigate diminished value if your car’s resale dropped significantly due to the accident

When to Get Help (and From Whom)

You should seek legal support if:

- An insurance company denies liability or offers an unfair settlement

- You’re dealing with irregular income from freelancing, sales, or gig work

- Your injuries reduce your long-term earning potential

- Your claim involves rideshare platforms, commercial exclusions, or multiple insurers

If your livelihood is on the line, you shouldn’t have to navigate the claims process alone.

Stop Guessing. Start Recovering.

If you’ve made it this far, you’re likely dealing with the same frustrating reality many Florida accident victims face: your paycheck disappeared overnight, your bills didn’t, and the insurance companies are making you do the math.

You didn’t ask for this, but now you need to get paid.

Applebaum Accident Group can help you move forward.

What We Do to Solve the Problem

- We connect you with experienced personal injury attorneys who know how to calculate and demand lost wages, including missed PTO, commissions, and future income.

- We match you with trusted medical professionals who can properly document your injuries, limitations, and treatment plan, ensuring your claim isn’t dismissed over technicalities.

- We navigate the insurance maze for you, making sure every form, deadline, and negotiation is handled with skill and urgency.

What Life Looks Like on the Other Side

Imagine checking your inbox and seeing confirmation that your full wage loss claim is being pursued, accurately, professionally, and aggressively. No more wondering if you’re missing something. No more chasing down adjusters. No more compromising your recovery to manage paperwork.

Instead of getting lost in the system, you get results, and the confidence that comes with knowing someone is finally fighting for your paycheck, your time, and your peace of mind.

📞 855-225-5728 | No pressure. No confusion. Just action.

Contact Applebaum Accident Group and Request Your Free Consultation Now.