Florida’s PIP insurance covers up to $10,000 for medical expenses and lost wages after a car accident, regardless of fault. To claim full benefits, treatment must begin within 14 days, and an “Emergency Medical Condition” must be diagnosed by a qualified physician.

If you’ve been injured in a Florida car accident, you’re likely hearing a lot about Personal Injury Protection, or PIP. But what exactly does it cover?

In this article, we’ll walk you through everything you need to know about PIP insurance in Florida:

- How it works

- What it pays for

- How much can you really get

- New legal developments

- Steps you should take to protect yourself

Let’s start by breaking down what PIP insurance in Florida really is and why it exists.

What is PIP Insurance in Florida?

Personal Injury Protection (PIP) is a mandatory part of Florida’s auto insurance landscape. It’s designed to pay for medical costs and lost income arising from a car accident, no matter who caused it. This makes Florida a “no-fault” state, streamlining claims and getting victims access to funds fast, without waiting for a drawn-out investigation.

How Florida’s No-Fault System Works

Under the no-fault model, when an accident occurs, you first turn to your own PIP insurance for compensation, regardless of who was at fault. This system aims to reduce the volume of personal injury lawsuits by ensuring that minor injury claims are handled quickly through insurance, not the courts.

But here’s the reality: while it sounds efficient, Florida’s system often leaves victims confused and undercompensated, especially when their medical expenses surpass PIP’s limits or they experience non-economic damages like pain and suffering.

Who is Covered by PIP in Florida?

- Drivers: Your own PIP coverage applies if you’re injured driving your vehicle.

- Passengers: Injured passengers without their own PIP policies are covered by the driver’s PIP.

- Pedestrians and Bicyclists: If you’re hit by a car while walking or cycling, the driver’s PIP typically covers your immediate medical expenses.

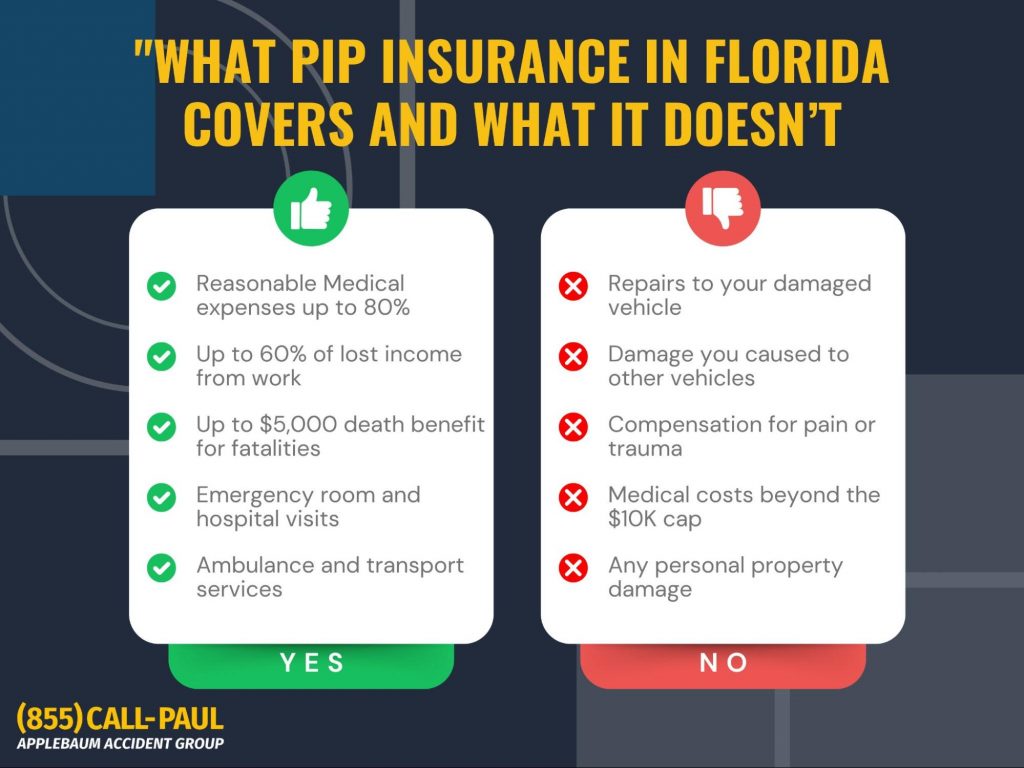

What Does PIP Insurance Cover?

PIP is often misunderstood as comprehensive coverage. It’s not. It covers a specific set of expenses with strict limits, leaving many accident victims unsure about how they’ll pay for additional costs.

Medical Expenses

PIP pays for 80% of necessary medical expenses, up to $10,000. These expenses must be directly related to injuries from the accident and be deemed “medically necessary.”

Covered treatments include:

- Emergency room visits

- Hospital stays

- Surgeries

- Imaging (e.g., X-rays, MRIs)

- Prescribed medications

- Physical therapy

Lost Wages and Death Benefits

If injuries prevent you from working, PIP compensates 60% of your lost income. For many, this is a lifeline during recovery, but it also means a significant gap, 40% of lost income is not covered.

If the worst happens and an accident proves fatal, PIP provides a $5,000 death benefit to cover funeral and burial expenses.

What PIP Doesn’t Cover

- Pain and suffering: Emotional distress and reduced quality of life are not compensated under PIP.

- Vehicle or property damage: These are addressed through separate coverages like Property Damage Liability (PDL).

- Non-essential treatments: Elective procedures or experimental therapies won’t be covered unless medically justified.

How Much PIP Coverage Can You Get?

By default, PIP provides $10,000 in benefits per person per accident. But there’s a critical catch: to unlock the full benefit, a licensed medical provider must diagnose you with an Emergency Medical Condition (EMC), a determination many accident victims don’t realize is required.

EMC Diagnosis: The Key to Unlocking Full Benefits

Without an EMC diagnosis, your PIP benefits are capped at $2,500. An EMC refers to a condition that, if left untreated, could lead to serious health risks. Getting this diagnosis promptly is not just a medical necessity, it’s a financial one.

At TeleEMC, our affiliated company, we’ve seen how a lack of qualified EMC providers can delay or even deny victims access to their rightful benefits. That’s why Applebaum Accident Group works closely with medical professionals who can make these evaluations swiftly and accurately.

Optional MedPay Coverage

To cover the 20% of medical expenses and other gaps that PIP doesn’t, many Floridians purchase Medical Payments Coverage (MedPay). It’s a wise investment, particularly if you’re concerned about out-of-pocket expenses following an accident.

For those looking to maximize their PIP benefits, we recommend reading our related article: Maximum PIP Coverage in Florida.

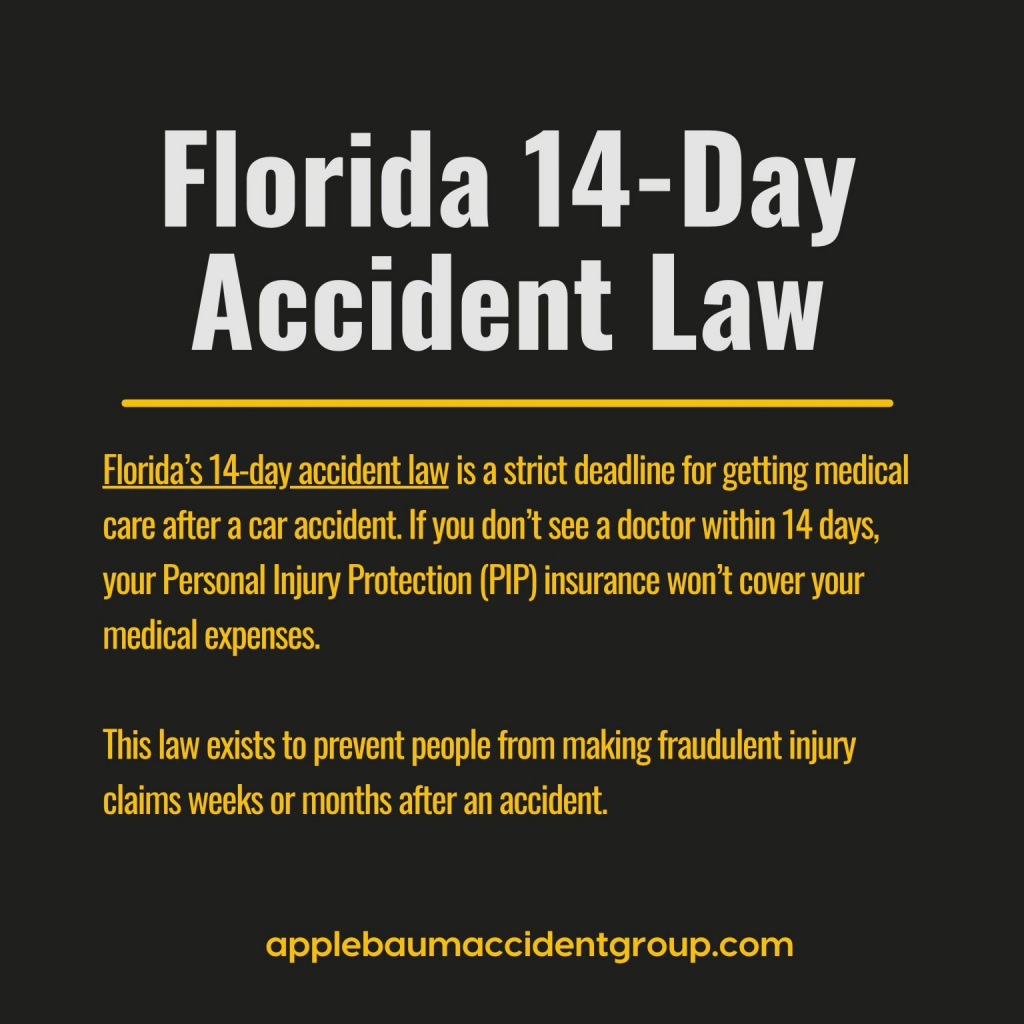

What is the 14-Day PIP Rule in Florida?

One of the most misunderstood aspects of Florida’s PIP law is the 14-day rule. Simply put, if you don’t seek medical treatment within 14 days of your accident, you lose access to PIP benefits.

For a detailed explanation of how this deadline works and the consequences of missing it, check out our guide on the Florida 14-Day Accident Law.

Why This Rule Exists

The 14-day rule was introduced to reduce fraudulent claims and ensure that injuries are promptly documented. However, it also puts genuine accident victims at risk of losing coverage if they delay seeking care, even for understandable reasons like shock or minor initial symptoms.

Who Can Diagnose an EMC?

Only certain providers are qualified to make the EMC determination that unlocks your full PIP benefits:

- Physicians (MD or DO)

- Dentists

- Advanced Registered Nurse Practitioners

- Chiropractors (for evaluation, but not for EMC diagnosis)

This nuance is where many victims slip up. A chiropractor may treat you but cannot make the EMC diagnosis required for full PIP access. That’s why our partner organization, TeleEMC, exists, to bridge this critical gap by connecting victims with qualified providers.

What Factors Determine Your PIP Payout?

Several key factors influence how much compensation you can access through your PIP coverage.

- Timely Treatment Within 14 Days: If you don’t receive medical treatment within 14 days of the accident, you forfeit your right to PIP benefits. This legal deadline is non-negotiable and applies to all Florida drivers and passengers.

- EMC Diagnosis by a Qualified Medical Professional: To access the full $10,000 in PIP benefits, you must be diagnosed with an Emergency Medical Condition by a qualified provider. Without this, your PIP payout is limited to $2,500.

- Deductibles Chosen at Policy Purchase: When you buy your auto insurance, you can select a PIP deductible, typically up to $1,000. While this lowers your monthly premium, it also reduces the amount available for your medical expenses after an accident.

- Coordination with Private Health Insurance: PIP serves as the primary coverage after an accident, but if your medical bills exceed PIP limits, your private health insurance may cover additional expenses. Coordination between PIP and your health insurer is critical to avoid paying out-of-pocket for costs that should be covered.

If your medical expenses surpass what PIP and the at-fault driver’s insurance can cover, read our article on What Happens When A Car Accident Claim Exceeds Insurance Limits In Florida.

- Subrogation Rights: Once your PIP insurer pays out your benefits, they often pursue subrogation, seeking reimbursement from the at-fault party’s insurer. While this typically happens behind the scenes, it can influence how much recovery is available from other claims, especially if BI coverage is limited.

Navigating these factors can be complex. At Applebaum Accident Group, we ensure that accident victims don’t miss these critical steps by connecting them with both medical professionals and attorneys who can optimize their claim outcomes.

How to Protect Yourself in Florida’s Changing Insurance Landscape

- Review and understand your PIP policy: Make sure you know what your PIP policy covers and what it doesn’t. If the law changes, understanding your existing policy will help you make informed decisions about future coverage.

- Consider purchasing additional MedPay and uninsured motorist coverage: These coverages can bridge gaps left by PIP’s repeal or limitations. MedPay helps with immediate medical bills, while UM/UIM coverage protects you if the at-fault driver is uninsured or underinsured.

- Seek medical treatment immediately after any accident: Even if you feel fine, getting evaluated promptly protects both your health and your legal right to claim insurance benefits. Delay can result in lost compensation.

- Consult with a personal injury lawyer: Navigating insurance claims, especially amid legal changes, requires professional guidance. Applebaum Accident Group connects accident victims with top-tier attorneys who ensure you receive the compensation and care you deserve.

Considering the risks of underinsured drivers, it’s a good idea to review our Step-By-Step Guide To Filing An Uninsured Motorist Claim In Florida.

PIP in Florida, Still Vital, But Possibly Evolving

Florida’s PIP insurance has long served as a critical safety net, providing swift access to funds for medical expenses and lost wages. Yet, legislative momentum suggests the system could change dramatically in the coming years, potentially increasing complexity and financial risk for accident victims.

Staying informed about these changes is your best defense. Whether PIP remains or is replaced by a BI-based system, Applebaum Accident Group is here to help. We connect accident victims with compassionate, results-driven attorneys and qualified medical providers, ensuring you receive the care and compensation you need, without getting lost in the legal shuffle.

If you’ve been injured and are unsure about your next steps, contact Applebaum Accident Group, we’ll put you in touch with the best lawyers who can advocate for your recovery and protect your rights.

Take Control of Your PIP Insurance Claim Before It’s Too Late

If you’re reading this, chances are you’re either facing the stress of navigating Florida’s complex PIP insurance system or worried about what happens if PIP is repealed. Whether you’ve already been in an accident or you’re planning ahead, one thing is clear: the system is confusing, the deadlines are strict, and the consequences for mistakes are serious.

That’s where Applebaum Accident Group steps in. We know that dealing with PIP, or preparing for its potential repeal, isn’t something you should do alone.

Here’s How We Can Help You Today:

✅ Connect you with top-tier personal injury attorneys who understand the intricacies of Florida’s evolving insurance laws and can maximize your financial recovery, whether through PIP claims or BI litigation.

✅ Ensure you receive qualified medical care, including a timely Emergency Medical Condition (EMC) evaluation through our affiliate, TeleEMC, to secure your full PIP benefits.

✅ Protect you against common pitfalls, like missing the 14-day treatment window or underestimating your future medical needs, mistakes that can cost you thousands.

With Applebaum Accident Group, your focus can stay where it should be, on healing and moving forward. Let us handle the rest.

📞 855-225-5728 | Request An Appointment