The Florida Personal Injury Protection (PIP) statute mandates that drivers carry $10,000 in no-fault insurance, paying 80% of medical expenses and 60% of lost wages after a car accident. To qualify, you must seek medical care within 14 days of the incident. Recent legal adjustments in 2025 clarified payment models but did not eliminate PIP.

This guide explains everything you need to know about the Florida PIP statute. You’ll learn:

- How the 14-day rule affects your rights

- What medical expenses are covered

- Whether Florida plans to abolish PIP.

Along the way, we’ll address practical worries about premium hikes, claim denials, and how to safeguard your benefits.

What Is the Florida PIP Statute?

Florida law requires all vehicle owners to carry Personal Injury Protection (PIP) insurance with a minimum of $10,000 in coverage. This coverage pays:

- 80% of your medical bills

- 60% of lost wages following a car accident

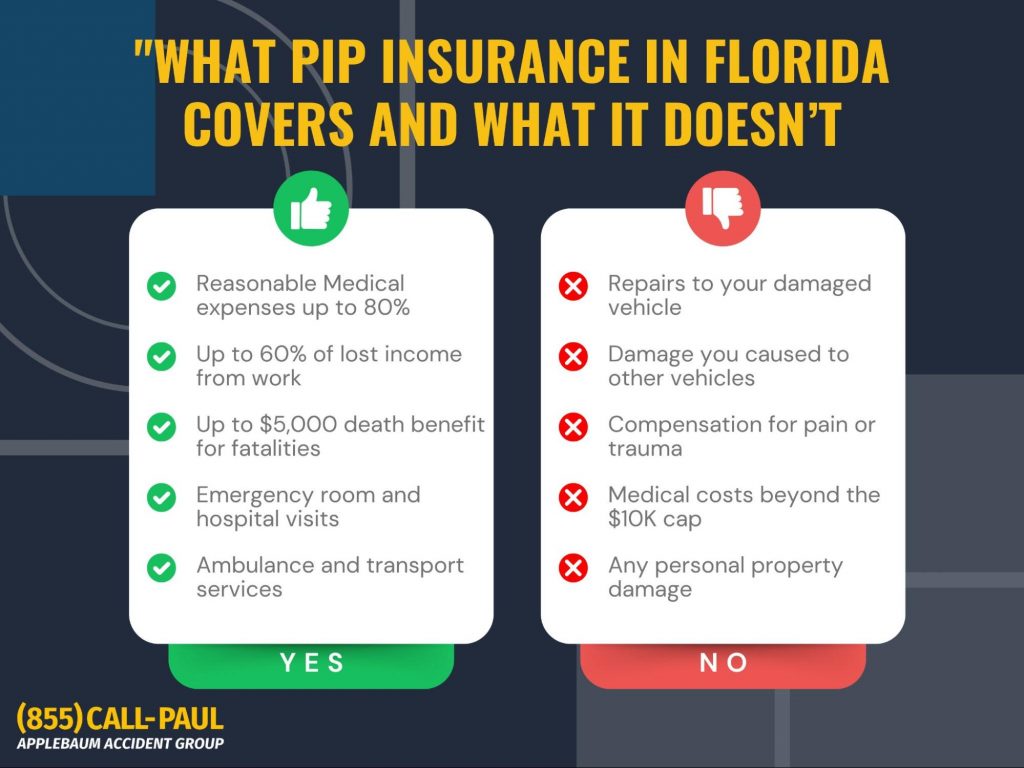

No matter who caused the collision. This no-fault structure ensures that injured parties receive prompt medical treatment without the delay of determining liability. Additionally, PIP includes a $5,000 death benefit for fatalities resulting from a covered accident.

Why PIP Exists: The No-Fault Principle

Florida’s no-fault system was designed to minimize litigation over minor traffic accidents and streamline payment for medical care. By allowing individuals to recover compensation through their own insurance, the statute reduces court congestion and ensures faster medical reimbursements. However, this system also limits the right to sue for pain and suffering unless a specific threshold, such as a permanent injury or significant disfigurement, is met.

What Is the PIP Rule in Florida?

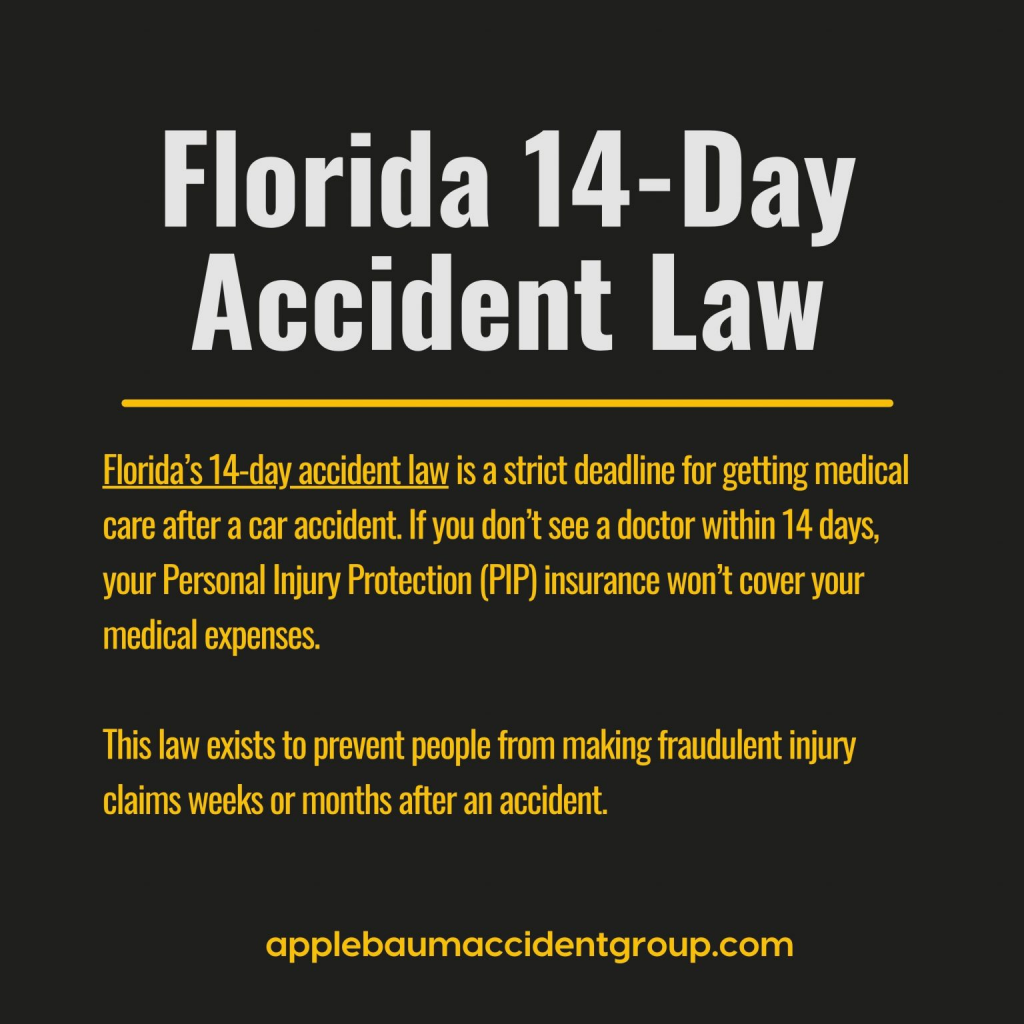

The 14-Day Rule Explained

Under Florida’s PIP statute, injured individuals must seek medical care within 14 days of the accident. Failing to do so results in a complete loss of PIP benefits. This strict timeline often creates anxiety, especially for those whose symptoms appear days or weeks later.

“If I don’t see a doctor within 14 days, can I still claim PIP?”

Answer: No. Once the 14-day period expires, PIP benefits are forfeited. However, you can still use your health insurance for accident-related medical care.

For a more detailed breakdown of how Florida enforces this rule and what exceptions may apply, check out our article: ‘Florida 14-Day Accident Law‘.

Emergency Medical Condition (EMC) Requirement

Accessing the full $10,000 PIP benefit hinges on obtaining a determination of an Emergency Medical Condition (EMC) from a qualified medical provider. Without this, PIP benefits are capped at $2,500.

Key Point: An EMC can be diagnosed after initial treatment, a fact often misunderstood by accident victims.

What Is Covered Under PIP?

Florida PIP covers a wide range of necessary medical services, including hospital care, surgery, and rehabilitation. It also reimburses 60% of lost income due to accident-related injuries. However, it’s critical to recognize what PIP does not cover:

- Pain and suffering damages

- Property damage to your vehicle

A frequent misconception is that PIP will pay for everything after a crash. In reality, its purpose is to provide basic, rapid coverage, not to fully compensate for all losses.

What Is the New Law in Florida for Personal Injury Protection?

Recent clarifications in 2025 expanded the ways insurers can fulfill PIP payment obligations. Notably:

- Hybrid payment models are now permitted, allowing insurers to pay 80% of billed charges, even when those charges fall below established fee schedules.

- The Florida Supreme Court confirmed this practice in Revival Chiropractic v. Allstate.

- There’s now greater oversight of 627.736(6)(b) requests, a tool insurers use to seek detailed provider documentation, with the goal of reducing payment delays.

Medical providers may now invoice insurers for the administrative costs related to fulfilling these documentation requests, a change that balances insurer oversight with provider compensation.

Is Florida Getting Rid of PIP?

Despite ongoing debates, as of 2025, Florida continues to mandate PIP coverage. Several legislative proposals have aimed to repeal the no-fault system, but none have succeeded. The primary argument for repeal is that PIP can be costly and inefficient, while opponents warn that abolishing it would create legal chaos and overburden courts with small injury claims.

Navigating PIP Claims: What You Must Know

Filing Deadlines and Insurer Obligations

Florida’s PIP statute imposes strict deadlines for both medical providers and insurers. Providers must submit their bills within 35 days of rendering treatment. Missing this deadline can result in non-payment, regardless of the care’s necessity.

Once a claim is properly submitted, insurers are required to pay or deny the claim within 30 days. However, they may legally pause payment if they need additional information, often through a formal 627.736(6)(b) request.

Insurer Requests Under 627.736(6)(b)

A 6(b) request allows insurers to request detailed medical records or documentation to verify treatment necessity. This request temporarily suspends their payment deadline until the provider responds.

Key Point: If a provider ignores a 6(b) request, the insurer is not considered overdue, and the provider cannot send a statutory demand letter to force payment. This detail often trips up providers and patients alike, creating frustration over delayed payments.

To avoid this situation, it is vital to work with providers who understand these procedural nuances and respond promptly to all insurer communications.

What Happens If PIP Isn’t Enough?

Despite its role in covering immediate medical costs, PIP’s $10,000 limit often falls short, especially in serious accidents. When this happens, additional options include:

- Suing the at-fault driver, provided they have Bodily Injury (BI) coverage.

- Using Uninsured Motorist (UM) coverage, which can protect you if the at-fault driver lacks adequate insurance.

- Pursuing pain and suffering damages, though these claims require meeting Florida’s strict injury threshold, typically involving a permanent injury or significant disfigurement.

If you’re wondering what steps to take after an accident beyond PIP coverage, don’t miss our guide: ‘What to Do After a Car Accident in Florida‘.

Client’s Questions About Florida’s PIP Statute

Will a PIP Claim Raise My Insurance Premium?

Often, yes. Even though PIP is a no-fault benefit, insurers may still consider PIP claims when adjusting premiums. This risk causes many individuals to hesitate before filing minor claims.

Does PIP Apply If I’m a Passenger or Pedestrian?

Yes. PIP covers passengers, pedestrians, and drivers injured in car accidents.

- If you’re a Florida resident, your own PIP policy applies, even if you were not driving.

- Non-residents injured in Florida may face different rules, depending on their home state’s insurance requirements and reciprocity agreements.

This broad application of PIP reinforces its role as a universal first line of protection for accident-related injuries within the state.

How Does PIP Work With Health Insurance?

PIP is considered the primary payer for accident-related medical care in Florida. Only after exhausting your PIP benefits should your health insurance step in to cover additional costs.

Some medical providers are trained to search for auto insurance first before billing your health plan to ensure compliance with Florida’s no-fault system. This hierarchy can be confusing, but it is essential to prevent claim denials or billing delays.

Legal Trends Affecting PIP in 2025

Hybrid Payment Methods Now Mainstream

Recent legal developments have reshaped how insurers fulfill PIP obligations. Insurers now have the discretion to either pay 80% of billed amounts or adhere to the statutory fee schedules for reimbursement. This flexibility was solidified by the Florida Supreme Court in Revival Chiropractic v. Allstate, providing clarity for both insurers and medical providers.

For policyholders and providers alike, this shift means that payment calculations may vary depending on how each insurer elects to manage claims.

Increased Focus on Preventing PIP Fraud

In 2025, there is a heightened emphasis on identifying and preventing PIP fraud. Insurers are conducting more aggressive investigations into claims they suspect are inflated or fabricated. As a result, both medical providers and patients must be vigilant in ensuring that all treatments billed to PIP are medically necessary and properly documented.

While these measures aim to reduce systemic abuse, they also increase the complexity of managing PIP claims, often leading to additional scrutiny and potential payment delays. Working with knowledgeable providers and legal professionals can help ensure compliance and avoid disputes.

How to Protect Your Rights Under Florida’s PIP Statute

Florida’s PIP statute remains a vital component of the state’s insurance landscape, offering a structured pathway to quick compensation after car accidents. However, its evolving rules, strict deadlines, and intricate documentation requirements can pose challenges.

Taking prompt action after an accident, seeking medical care within 14 days, ensuring proper EMC determinations, and consulting professionals, can make the difference between receiving full benefits or facing unnecessary denials.

If you’re feeling overwhelmed by the PIP process or need help pursuing additional compensation beyond your PIP benefits, we’re here to help. We specialize in connecting car accident victims with attorneys who take their cases, and their recovery, seriously.

Get the Help You Need Navigating Florida’s PIP Statute

The Florida PIP statute can leave accident victims feeling trapped, confused by strict deadlines, unsure about coverage limits, and anxious about making mistakes that could jeopardize their recovery. You don’t have to figure this out alone. The Applebaum Accident Group is here to remove the guesswork and connect you with the right professionals to protect your rights and maximize your recovery.

How Applebaum Accident Group Can Help You:

- Connect You with the Right Attorney: We match you with an attorney who understands the complexities of PIP claims and fights to ensure your medical bills, lost wages, and other damages are covered properly.

- Introduce You to Qualified Medical Providers: Through our network, including industry leaders like TeleEMC, we help you access medical professionals who understand how to properly document Emergency Medical Conditions (EMCs) to secure your full PIP benefits.

- Guide You Through the Claims Process: Our team provides personalized support to help you avoid pitfalls like missing the 14-day treatment window and much more.

What Life Looks Like When You Use Our Solutions

Instead of feeling stressed and uncertain about whether your claim will be paid or your medical bills will go uncovered, you’ll have a clear path forward. With Applebaum Accident Group in your corner, you’ll gain:

- Peace of mind knowing your claim is being handled by experts.

- Confidence that you’ve been connected with attorneys and doctors who understand every nuance of Florida’s PIP statute.

- Relief from the burden of navigating complex insurance systems alone.

Take the first step toward resolving your claim and securing the care and compensation you deserve. Contact Applebaum Accident Group today, your recovery starts with the right connection.

📞 855-225-5728 | Request An Appointment