Yes, you can and often must file a police report after an accident in Florida, especially if there are injuries, fatalities, or property damage exceeding $500. If you didn’t report it at the scene, Florida law gives you up to 10 days to file a report. Minor accidents may be self-reported online.

After an accident, confusion and uncertainty are natural, especially when you’re unsure about legal obligations. In Florida, whether you must file a police report depends on factors like injury severity, property damage, and whether the incident involved a commercial vehicle or DUI.

This guide explains:

- When reporting is mandatory

- How much time you have to do it

- Why reporting is often the wisest course of action.

- How medical care deadlines could affect your insurance benefits.

By the end of this article, you’ll be equipped with practical knowledge to protect yourself legally and financially after any crash.

Can You File a Police Report After an Accident in Florida?

Yes, you can, and in many cases, you must, file a police report after an accident in Florida. State law requires you to report crashes that involve specific circumstances. Knowing when it’s mandatory versus optional will help you avoid legal pitfalls and protect your financial interests.

When It’s Mandatory

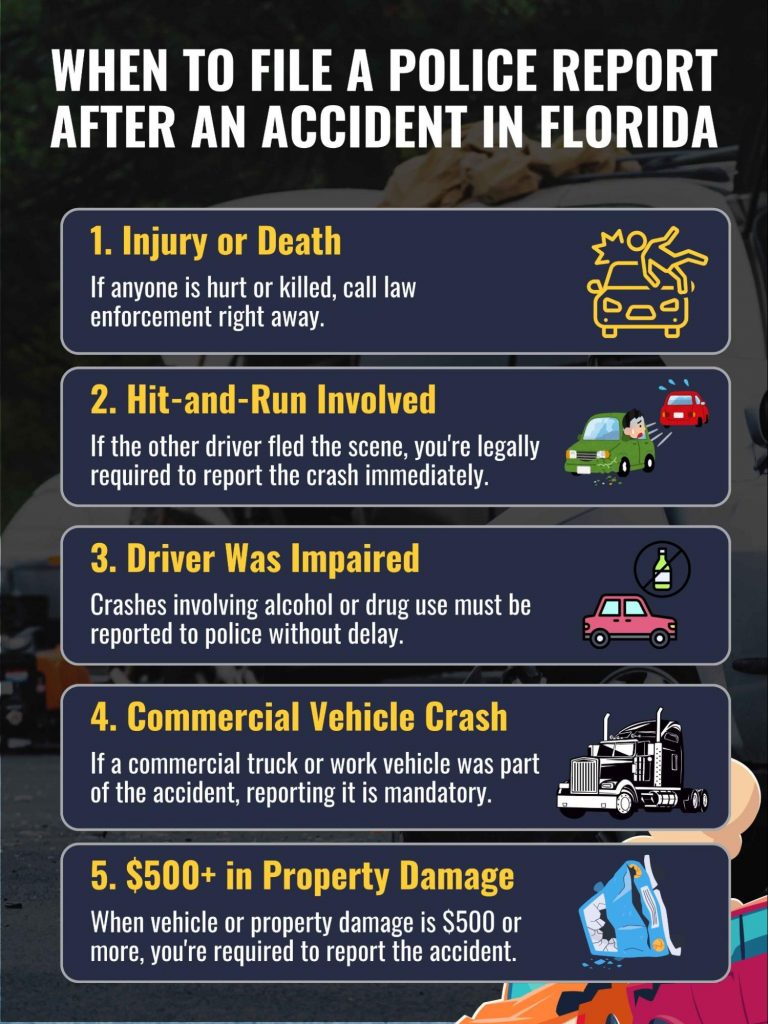

You are legally required to report the accident to law enforcement immediately if any of the following apply:

- Someone is injured or has died.

- The crash involved a hit-and-run driver.

- The crash involved a driver under the influence.

- A commercial vehicle was involved.

- There is $500 or more in property damage.

Failure to report under these conditions can lead to license suspension, fines, or even criminal charges.

When It’s Optional

If the accident results in property damage under $500 and no injuries, you are not legally required to call the police. In these minor cases, you can opt for self-reporting through Florida’s “Driver Report of Traffic Crash” system. However, even when optional, filing a report can help protect you against future claims or disputes.

How Long Do I Have to File a Police Report After an Accident in Florida?

The 10-Day Rule

If you didn’t report the crash at the scene, Florida law requires that you file a report within 10 days. This deadline applies whether you choose to self-report or if law enforcement instructs you to file later. Delaying beyond this window can compromise your legal standing and affect insurance claims.

Self-Reporting Option

For accidents that do not meet the mandatory reporting thresholds, Florida offers a self-reporting option. You can complete the “Driver Report of Traffic Crash” form either online or by mail. This flexibility is designed for minor incidents but does come with risks, especially when dealing with insurance companies.

Why Quick Reporting Matters

- Avoid potential legal penalties.

- Facilitate smoother insurance claims.

- Establish an official record that can protect you against false claims or disputes later.

Real Concern: “Do I Need a Report If I’m Not Going Through Insurance?”

Yes, it’s often wise to file a report even if you don’t plan to involve your insurer. Without an official record, the other party could later file a claim against you, leaving you legally exposed. Filing a report is a safeguard, not just a bureaucratic step.

Do You Have to Call the Police After a Minor Car Accident in Florida?

Florida law doesn’t require you to call the police for every minor accident, but it’s strongly recommended. Police involvement creates an official record that may be critical if insurance disputes arise or if the other party later changes their story.

Situations Where You Can Self-Report:

- The property damage is under $500.

- No injuries occurred.

- All parties willingly exchange information at the scene.

In these cases, you can file a self-report with the Florida Department of Highway Safety and Motor Vehicles.

Why People Worry: “What If the Other Driver Later Claims Injury?”

This is a legitimate concern. Without a police report, it’s your word against theirs. Filing a report, whether with the police or through self-reporting, can protect you from false injury claims that may surface days or weeks later.

Expect Police Involvement Anyway

While not always required, many Florida jurisdictions dispatch officers even for minor fender benders. It’s common practice, particularly in urban areas or when rental vehicles are involved, to document the incident thoroughly regardless of severity.

What Is the New Law in Florida for Car Accidents?

Florida’s traffic laws continue to evolve, with new policies that significantly impact how accident victims must respond after a crash. The most notable recent change centers on timely medical care and accident reporting obligations.

Medical Attention Within 14 Days

Under Florida’s no-fault Personal Injury Protection (PIP) law, accident victims must obtain medical attention within 14 days of the crash to qualify for PIP benefits. This is non-negotiable, if you delay treatment beyond this period, your eligibility for compensation under PIP may be lost. This underscores the need to act swiftly, even if injuries seem minor at first.

For a deeper look at how Florida’s 14-day medical rule affects your PIP benefits, check out: Florida 14-Day Accident Law | What You Need To Know.

Increased Penalties for Failing to Report

Failing to report certain accidents isn’t just an administrative lapse, it can result in license suspension, fines, or even criminal charges. Florida enforces these penalties to ensure that crashes involving injuries, deaths, or significant property damage are properly documented for public safety and legal accountability.

Updated Reporting Process

The state has also expanded the self-reporting option for minor crashes. If your accident doesn’t involve injuries or significant damage, you can now complete the “Driver Report of Traffic Crash” form and submit it online or by mail. This option provides more flexibility but can introduce risks, particularly when dealing with insurance claims or potential legal disputes.

Why Tourists Often Get Caught Off Guard

Florida’s accident reporting laws frequently confuse tourists and out-of-state drivers unfamiliar with the 14-day medical rule and self-reporting options. Many assume that minor accidents don’t require documentation, only to face legal complications or insurance denials later. If you’re visiting Florida, it’s vital to understand these local requirements before getting behind the wheel.

How Many Days After an Accident Can You File a Claim in Florida?

While the law requires a police or self-report within 10 days, most insurance policies also demand that claims be reported promptly, often within the same timeframe. Some insurers may have shorter or more flexible deadlines, but failing to notify your carrier quickly can weaken your case or lead to denial of benefits.

Why Fast Action Matters

Promptly filing a claim is critical to:

- Preserve your right to PIP benefits.

- Avoid disputes about the cause or extent of your damages.

- Ensure your insurer can conduct a timely investigation.

Delaying your claim can jeopardize your eligibility for reimbursement of medical expenses, lost wages, and other losses.

Do You Need a Police Report to File an Insurance Claim?

In most cases, yes. Insurance companies typically require a police report number to process your claim, even for minor accidents. Without it, your claim may be delayed, reduced, or denied altogether. Filing a report, whether mandatory or not, is a key step in protecting your rights.

Should You Always File a Police Report, Even for Minor Accidents?

The Pros of Filing

Even when not legally required, filing a police report offers several clear advantages:

- Legal protection: Establishes an official record that can be referenced if disputes arise.

- Simplifies insurance claims: Most insurers require a report to process accident-related claims.

- Helps avoid future conflicts: Documented facts reduce the risk of the other party later changing their story.

The Cons of Filing

While generally advisable, filing a report does come with some downsides:

- Time-consuming: Waiting for law enforcement and completing paperwork can be inconvenient.

- Potential for tickets: If you’re found at fault for the accident or committed a traffic violation, filing may result in citations.

Best Practice: File the Report

The best approach is to file a report, even for minor accidents. This is especially true if you are driving a rental car or are an out-of-state driver. A documented report can be your strongest defense against future liability claims.

Hidden Costs: “Loss of Use” Fees

Many rental companies in Florida impose “loss of use” fees, charging you for the time the vehicle is out of service for repairs. Without a police report, disputing these fees becomes much more difficult.

Worry About Being Scammed?

One of the most common concerns is: “What if the rental company scams me?” A police report significantly reduces this risk by providing third-party documentation of the damage and circumstances, shielding you from false claims or excessive fees.

Does My Foreign Insurance Cover Me in Florida?

Not necessarily. Many foreign insurance policies do not cover rentals in the United States, including Florida. Before declining rental insurance, verify your coverage carefully to avoid being left unprotected in case of an accident.

Can I Be Fined for Not Reporting a Minor Accident?

Only if the accident meets the mandatory reporting thresholds, injury, death, or property damage of $500 or more. If your crash is truly minor, you may self-report without fear of penalties. However, choosing not to report at all can leave you vulnerable to future legal complications.

What’s the New Requirement for Medical Care?

Florida law now requires accident victims to seek medical care within 14 days of the crash to qualify for Personal Injury Protection (PIP) benefits. Missing this deadline can disqualify you from receiving compensation for medical bills and related costs.

Need help obtaining official documentation after your crash? Follow our detailed guide: How to Get a Police Report for Your Florida Car Accident.

Stay Protected, Know Your Rights and Responsibilities

Filing a police report after a car accident in Florida is more than a legal formality. It’s about protecting your rights, avoiding disputes, and ensuring your insurance claim proceeds smoothly. Whether you’re involved in a minor fender bender or a serious crash, knowing when and how to file a report ensures you’re safeguarded against unnecessary risks and complications.

Take Control of Your Accident Case with Applebaum Accident Group

If you’re unsure about whether to file a police report after an accident in Florida, chances are you’re also wondering what other steps you need to take to protect your health, your legal rights, and your financial future. Navigating Florida’s accident reporting laws, insurance claims, and legal processes can be overwhelming.

How Applebaum Accident Group Can Help You Right Now

- Immediate Legal Referrals: We quickly connect you with a trusted attorney from our vetted network, so you get legal guidance specific to your accident situation and reporting obligations.

- Access to Medical Professionals: Unsure about the 14-day rule for medical care? We link you with experienced providers who can evaluate your injuries and document your case properly, preserving your eligibility for Personal Injury Protection (PIP) benefits.

- Clear Guidance on Reporting and Claims: Whether you need to file a police report, a self-report, or a complicated insurance claim, we walk you through it step-by-step to avoid costly mistakes and delays.

With Applebaum Accident Group by your side, you can move forward confidently, knowing that every critical detail is handled. From ensuring your police report is filed properly to securing the right legal and medical support, we make sure you avoid the pitfalls that trip up so many accident victims in Florida.

You’ll stop second-guessing whether you did the right thing, and start focusing on what matters: your recovery and your peace of mind.

Applebaum Accident Group will put you in touch with the best lawyers and medical providers to help you move forward after your accident. Your protection and peace of mind start here.

📞 855-225-5728 | Request An Appointment