In Alabama, uninsured motorist (UM) coverage helps pay your bills if you’re hit by a driver with no insurance. It’s optional but strongly recommended due to the state’s high uninsured rate. You can even stack coverage across vehicles for extra protection.

If you’ve been in a crash with an uninsured driver or aren’t sure whether your policy protects you, Applebaum Accident Group can help. We connect accident victims with attorneys who understand the nuances of UM/UIM claims, and fight to make sure you’re not left footing the bill for someone else’s mistake.

Want the full breakdown on how uninsured motorist coverage works in Alabama, and how to avoid the most expensive mistakes drivers make? Keep reading.

What Is Uninsured Motorist Coverage in Alabama?

UM vs. UIM: Know the Difference

Uninsured motorist (UM) coverage steps in when you’re hit by someone who doesn’t carry any liability insurance. It helps cover your medical bills, lost wages, and other damages you’d typically expect the at-fault driver to pay for.

Underinsured motorist (UIM) coverage applies when the other driver does have insurance, but not enough to fully cover your damages. This is common in Alabama, where minimum liability limits are low and medical costs can easily surpass coverage amounts.

Together, UM and UIM serve as a safety net when the other party can’t pay what they owe.

Is UM Coverage Required in Alabama?

Here’s where many drivers make a costly mistake: Alabama doesn’t require you to carry UM/UIM coverage. It only requires that your insurer offers it. To reject it, you must sign a waiver, and unfortunately, many drivers do this without fully grasping the risks.

A lot of people assume UM comes with every policy. It doesn’t. If you don’t recall signing that waiver, request a copy from your insurer. You may discover that you opted out of coverage you desperately need.

Why You Need UM/UIM in Alabama

Key Reasons to Carry It

- 1 in 5 drivers in Alabama is uninsured. That’s not a stat, it’s a warning. The odds of getting into a crash with someone who can’t pay are high.

- The state minimum? Just $25,000. One ER visit could blow past that in a few hours.

- Suing an uninsured driver won’t help. If they don’t have insurance, they probably don’t have assets either.

That means unless you have coverage, you absorb the costs.

Stacking Coverage: How It Works

One of Alabama’s more consumer-friendly features is the ability to stack UM/UIM coverage across multiple vehicles:

- Own three cars with $25,000 UM on each? You can stack them for $75,000 in available benefits.

- Even passengers and resident relatives may benefit from stacked policies, if you know how to access it.

Don’t assume your insurer will explain this to you. Many don’t, and that oversight can cost you tens of thousands in lost benefits.

Can Someone Drive My Car Without Being on My Insurance?

In most cases, yes, Alabama follows a “permissive use” rule. If you give someone permission to drive your car, they’re covered under your liability policy.

But here’s the catch: If they cause an accident and the other party is uninsured, your UM coverage may not protect you. This depends on how your policy defines the insured and whether UM applies only when you’re the driver.

Before you hand over your keys, double-check with your insurance company. A simple call could save you a massive headache.

What’s the Penalty for Driving Without Insurance in Alabama?

Driving uninsured in Alabama carries real consequences:

- First offense: Up to $500 in fines and immediate license suspension.

- Second offense: Fines increase to $1,000, with longer license suspension and vehicle registration revocation.

- Instant verification: Law enforcement can now check your insurance status during traffic stops or accident reports on the spot.

Whether you’re at fault or not, being without coverage in a state with strict penalties and high uninsured rates puts you, and your finances, at serious risk.

Common Misunderstandings That Cost Drivers Thousands

What People Get Wrong

- “The police report handles everything.” It doesn’t. Your insurer still needs official notice and proof of the uninsured driver.

- “I thought I had UM/UIM.” Many drivers reject this coverage without realizing it, usually buried in fine print.

- “UM covers car damage, right?” Not always. Unless your policy includes uninsured motorist property damage (UMPD), you could be left paying out-of-pocket.

Situations That Lead to Denied Claims

- Settling without notifying your insurer: This mistake voids your claim under Alabama case law (Lambert v. State Farm).

- Misunderstanding stacking rules: Many assume all policies stack equally, some don’t.

How to Check or Add UM/UIM Coverage

Ask Your Insurer These Questions

- “What are my current UM/UIM limits?

- “Does my policy allow stacking across multiple vehicles?”

- “Would my coverage apply if I’m hit while biking or walking?”

If they can’t give you clear answers, that’s a red flag.

Get Covered, Even If You Think You’re Safe

- You can often add $100,000+ in coverage for less than $10/month.

- Don’t rely on bundled discounts alone, they often hide weak points in your protection.

- Schedule a policy review and confirm your protection in writing.

Protect Yourself the Smart Way

Uninsured drivers are everywhere in Alabama, and even those with insurance may not carry enough to protect you after a serious crash. If you don’t actively confirm your uninsured motorist coverage, you might only find out it’s missing when it’s too late.

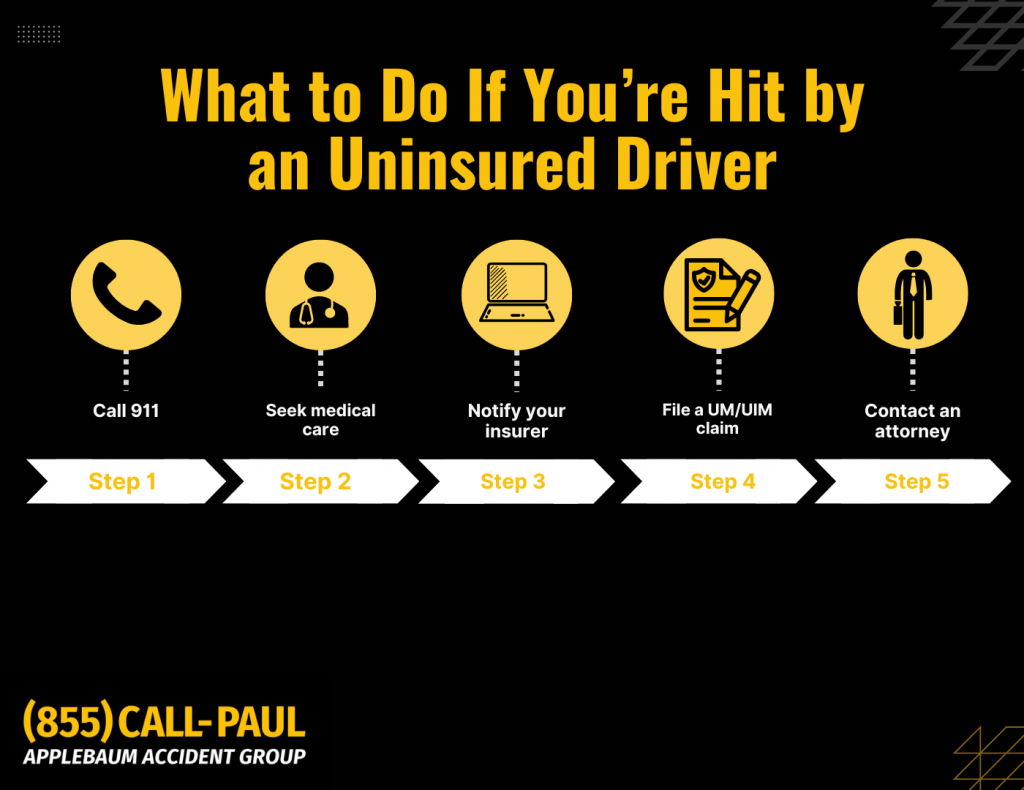

When You’re Hit by an Uninsured Driver, We Step In

It’s not just about having coverage, it’s about knowing how to use it. After an accident with an uninsured or underinsured driver, insurance companies often make the process confusing, slow, or downright combative. You shouldn’t have to fight that battle alone.

That’s where Applebaum Accident Group comes in.

Here’s how we can help:

- Legal Clarity: We connect you with attorneys who know how to unlock full UM/UIM benefits, even when insurers push back.

- Case Support: Our network includes professionals who’ll ensure you don’t miss deadlines, stack improperly, or waive your rights by accident.

- Maximum Payouts: We help injured drivers avoid mistakes that cost thousands, and often get them more than they expected.

Whether you’re unsure if you have coverage, facing a denied claim, or simply don’t know where to start, 👉 Applebaum Accident Group is here to help.

📞 855-225-5728 | Request An Appointment

Let us connect you to someone who actually listens, and fights for what you deserve.

Uninsured Motorist (UM) Questions from Alabama Drivers

My insurer denied my UM claim, what now?

Don’t panic. Under Alabama’s Lambert rule, you may still recover if you can prove two things:

- The at-fault driver had no coverage.

- You followed proper notice procedures with your insurer.

Missing either step could give your carrier a reason to deny, so consult a legal expert if you’re unsure.

Will my rates go up if I file a UM claim?

Possibly, but not always. Some insurers won’t raise premiums for non-fault accidents, especially if you’re using uninsured motorist coverage. Still, it’s smart to ask your agent directly before filing.

How do I prove the other driver was uninsured?

Act fast. Your insurer might require:

- A written denial of coverage from the other driver’s insurance company, or

- Evidence that no active policy existed at the time of the crash.

Delays in tracking this down can stall your payout, so the sooner you gather proof, the better.