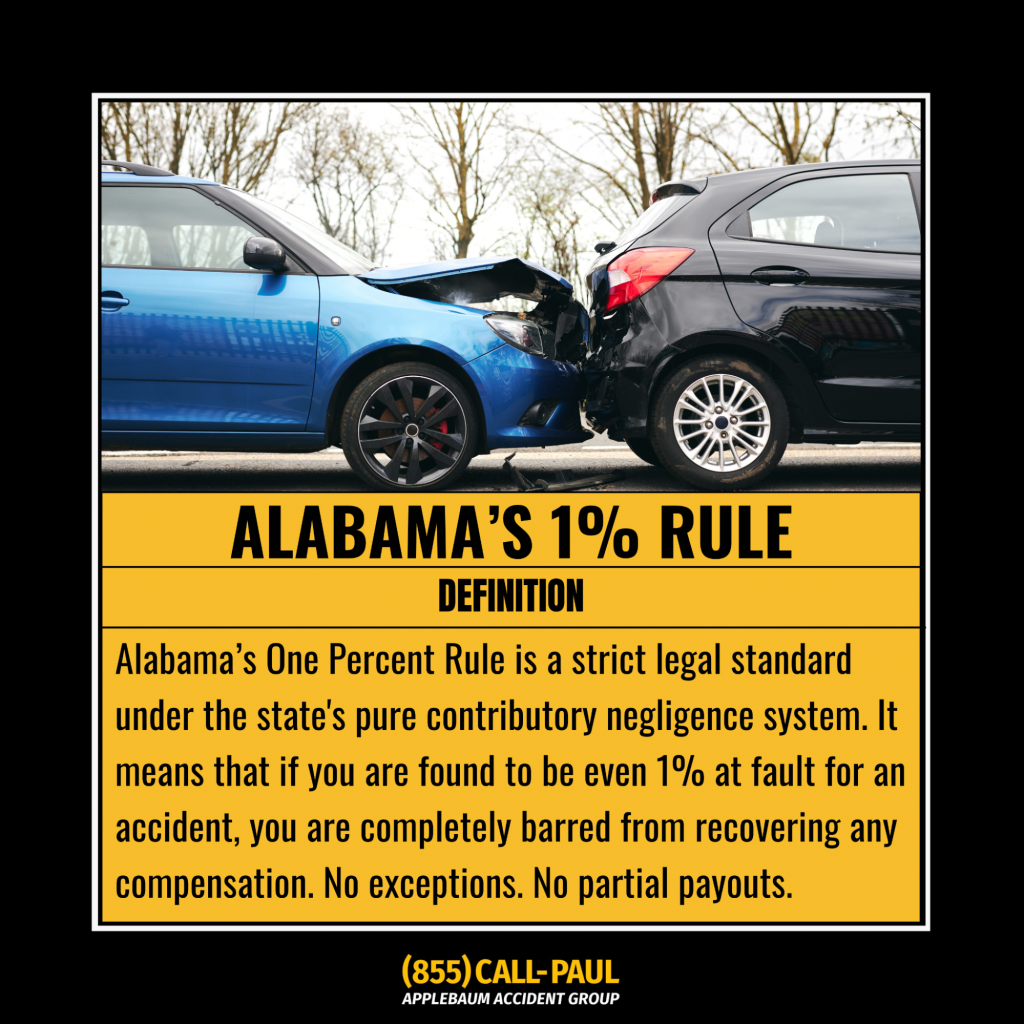

Alabama is a fault state with a strict contributory negligence rule, if you’re even 1% at fault, you lose your right to recover damages. Drivers must carry 25/50/25 liability coverage, but uninsured motorist and medical payments coverage can help cover gaps.

That’s why extra coverage like Uninsured Motorist (UM) and Medical Payments (MedPay) can save you from paying out of pocket.

Here’s what that means for you:

- If you don’t document the crash properly, you risk being blamed under Alabama’s strict rules.

- If you post the wrong thing online, your insurer could use it against you.

- If you’re underinsured, or relying on a rental contract you barely read, you could be on the hook for bills you can’t afford.

That’s exactly why Applebaum Accident Group exists. We don’t represent you in court, we connect you to the right attorneys who know how to fight 1% fault claims, dispute unfair denials, and protect your rights under Alabama’s tough insurance laws.

We do this because I’ve seen too many injury patients lose their case simply because they didn’t have the right help when they needed it most.

If you want to see exactly how these laws work, and how you can protect yourself from surprises that can cost thousands, keep reading. The next few sections break down real pitfalls, practical steps, and the biggest misconceptions that catch Alabama drivers off guard every day.

Is Alabama a No-Fault State for Car Accidents?

No, Alabama is not a no-fault state. It’s one of the strictest in the country thanks to its pure contributory negligence rule. In plain English: if you’re even 1% at fault, you may be barred from any recovery.

Example: Two drivers collide at an intersection. Driver A runs a red light, but Driver B was speeding just a little. Driver B could lose their claim entirely because speeding, however minor, counts as partial fault.

This harsh rule applies whether you’re driving your personal car or a rental. One mistake many drivers make is assuming that the rental company’s insurance will “cover everything,” even if they share blame. It won’t. If you’re partly at fault, the insurance company can deny your claim altogether.

The fix? Documentation. Take photos of both cars, skid marks, street signs, and weather conditions. Get witness statements and the officer’s name. One small detail can help prove you were truly not at fault, and that means everything under Alabama law.

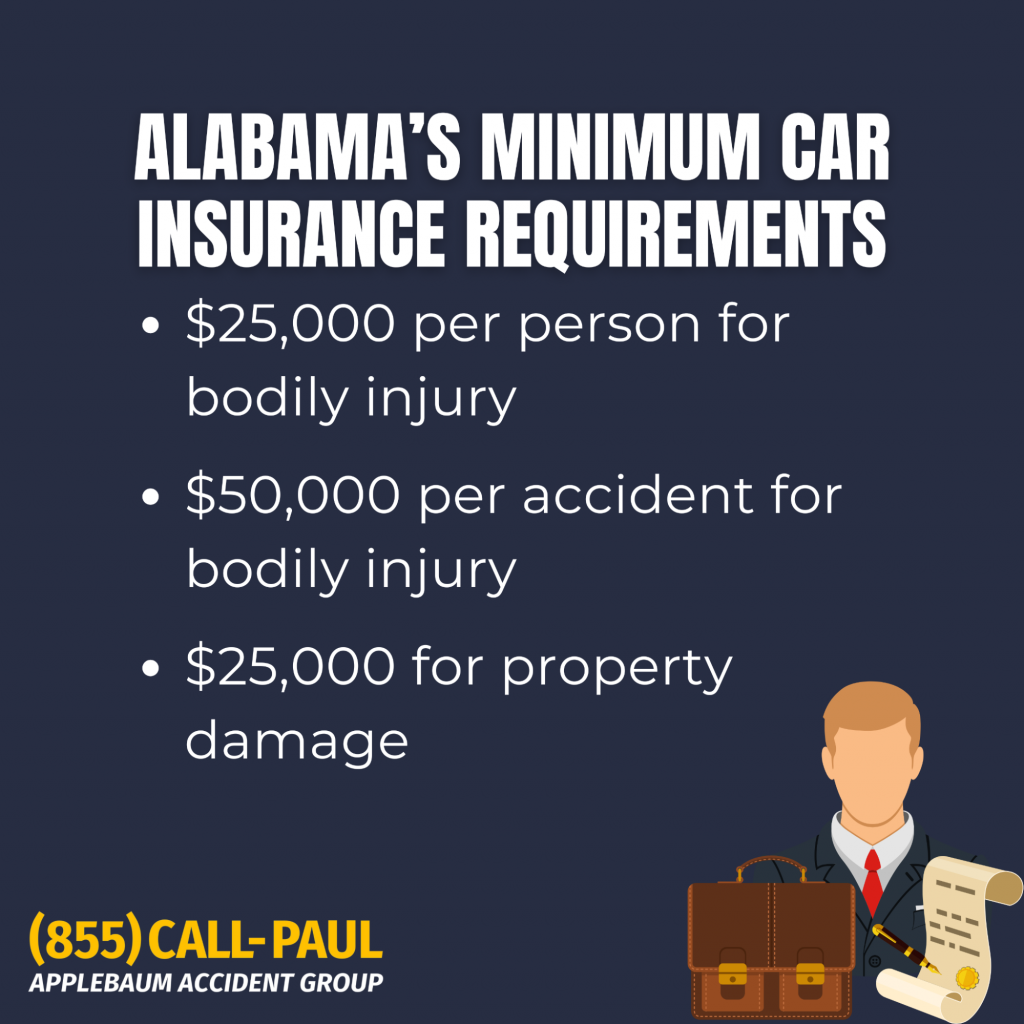

Alabama’s Minimum Car Insurance Requirements

Alabama law says every driver must carry at least 25/50/25 liability coverage:

- $25,000 per person for bodily injury

- $50,000 per accident for bodily injury

- $25,000 for property damage

This covers the other party’s losses if you’re at fault. But here’s the catch: it doesn’t cover your medical bills or your own car repairs. And if multiple vehicles are involved or injuries are serious, the minimum limits get eaten up fast, leaving you responsible for the rest.

Should you add extra coverage? If there’s one thing I always tell drivers: Uninsured/Underinsured Motorist (UM/UIM) and Medical Payments (MedPay) can protect you when the other driver doesn’t have enough coverage, or any at all. Too many drivers learn the hard way that the minimum is just that, the minimum.

Who Pays After an Accident in Alabama?

Who pays depends on who’s at fault, and remember, 1% fault can make a big difference here.

- Your Insurance: Covers the other party if you’re at fault, up to your policy limits.

- Their Insurance: Pays your costs if they’re at fault and you’re completely fault-free.

- No Insurance or Not Enough: Your UM/UIM coverage steps in. Without it, you could be stuck paying out of pocket.

And don’t overlook subrogation rights. If your insurer pays your claim, they can sue the at-fault driver to get reimbursed, and that can drag you into more paperwork you didn’t expect.

Common question: “Do I need UM if I already have liability?”

Yes. Liability protects the other driver if you’re at fault. UM protects you if the other driver is uninsured or flees the scene.

What If the Other Driver Lies or Flees?

It happens more often than you’d think. If the at-fault driver lies about what happened or drives away, you’ll lean heavily on your UM coverage, if you have it.

Here’s why a police report matters: Insurers take official reports seriously. A single sentence on a report can make or break your claim under Alabama’s contributory negligence rule.

But what if the report is wrong?

It happens. Experts recommend:

- Requesting a copy as soon as possible

- Filing a supplemental statement with the correct facts

- Providing photos and witness statements to back you up

Those small steps help protect you when the other side tries to twist the story, and they can keep you from falling into that 1% trap.

Will My Insurance Go Up If I’m Not at Fault?

Generally, no, if you truly have zero fault, your premiums shouldn’t skyrocket. But many Alabama drivers feel blindsided when rates go up anyway.

Insurers look at:

- Claim frequency, multiple claims can flag you as a higher risk.

- Type of claim, injuries or big payouts can have bigger impacts.

- Where you live and drive, high-risk areas sometimes push rates up for everyone.

One client told us, “I’m terrified my rates will double even though the crash wasn’t my fault.” If that’s you, get your policy details in writing, and don’t be afraid to shop for a better carrier if you’re penalized unfairly. Dispute errors on your CLUE report, your claim history can stick around for years.

How Long Does a Wreck Affect My Insurance in Alabama?

A single wreck can stay on your insurance record for three to five years, sometimes longer if there’s a big payout involved. Even if you’re not at fault, the claim still shows up on your CLUE report, the database insurers use to calculate risk.

That means if you switch carriers, they’ll see your accident history. This surprises many drivers who think switching companies “wipes the slate clean.” It doesn’t.

Rental car accidents count too. Many drivers think damage to a rental stays between them and the rental company, but your personal policy usually pays out, so it shows up just like any other accident. If you’re in Alabama, the same harsh fault rules apply to rentals, so the stakes don’t change just because you’re driving a different car.

What Happens If You’re in an Accident During Work?

This catches more people off guard than you’d think. Using your personal car for work errands, dropping off a package, driving to a client meeting, can void your personal auto coverage if your policy excludes business use.

One driver told us, “I’m worried my insurance won’t cover me because I was technically on a work trip.” That’s a real risk. Many personal policies specifically exclude coverage for “business use” or “commercial purposes.”

What to do?

- Check your policy documents for phrases like “business exclusion.”

- If you regularly use your car for work, talk to your insurer about adding a commercial auto policy.

- Don’t assume your employer’s coverage protects you, it may not.

One tiny detail, like where you were headed, can mean the difference between a covered claim and paying everything out of pocket.

Misconceptions That Leave Drivers Broke

Even smart drivers make these assumptions, and they’re exactly what Alabama’s tough negligence laws exploit.

- “My credit card covers everything.” Not true. Credit cards usually offer collision damage coverage for rentals, but not liability for injuries or damage to other cars. If you cause a wreck, you could be on the hook.

- “I don’t need insurance if I’m not at fault.” In Alabama, you can be found partly at fault even when the other driver is reckless. That tiny percentage means you get nothing. Without UM or MedPay, you may face uncovered bills.

- “A minor fender-bender doesn’t need to be reported.” Some drivers think they can “work it out privately.” But failing to notify your insurer within the required time can void your claim later.

- Social posts can backfire. One small detail you share, “I’m fine!” or “No big deal”, can be used to argue your injuries aren’t real. I’ve seen it happen more than once.

Step-by-Step: What to Do After a Crash

Here’s the simple checklist I wish every Alabama driver kept in their glovebox:

- Stop and check for injuries. Call 911 if needed.

- Call the police. Always file a report, don’t skip this.

- Exchange information. Get the other driver’s name, insurance company, and license plate.

- Take photos. Capture both vehicles, road conditions, traffic signs, and any visible injuries.

- Get witness names and contact info. Neutral statements help if fault is disputed.

- Notify your insurer immediately. Many policies require notice within a short window, missing this can void your claim.

- If you were driving a rental, call the rental company too. They’ll need to inspect the damage.

- Don’t admit fault, ever. Even a simple “I’m sorry” can be twisted into an admission.

A little preparation now can mean the difference between getting a fair payout or watching Alabama’s 1% rule ruin your recovery.

When to Talk to a Lawyer

Don’t wait until a small problem becomes a lost claim. Get help if:

- You’re injured and facing a 1% fault fight.

- You’re hit by an uninsured or underinsured driver.

- Your insurer delays or lowballs your payout.

- Your crash happened during work travel and you’re worried about a business-use exclusion.

The right attorney can spot gaps, challenge fault, and handle deadlines so you don’t lose your chance to recover.

Protect Yourself Under Alabama’s Harsh Fault Rules

Alabama’s contributory negligence standard leaves no margin for error. One careless statement, one missing photo, or one forgotten deadline can wipe out your claim completely.

Your best protection? Know your policy. Take photos. Save records. Don’t assume “minor” means “covered.” And when the situation is bigger than you can handle, don’t go it alone.

How Applebaum Accident Group Can Help

When you’re staring down Alabama’s strict fault laws, one mistake can cost you everything. It doesn’t matter if you’re 99% right, if you’re just 1% wrong, your recovery could vanish. Add in confusing policy exclusions, pushy insurance adjusters, or a rental agreement that shifts blame to you, and you’re up against a system designed to protect the company’s bottom line, not yours.

That’s exactly where Applebaum Accident Group steps in. Here’s how we help you protect what’s rightfully yours:

- We connect you to attorneys who know Alabama’s contributory negligence traps inside and out, and fight unfair blame when the insurer tries to stick you with it.

- We make sense of overlapping coverages and hidden clauses, from personal auto to rental contracts to credit card insurance, so you’re not surprised when it’s too late.

- We guide you through every deadline and next step, so your claim doesn’t fail because of one overlooked report or missed signature.

Your recovery should never depend on what an adjuster decides behind a desk.

📞 855-225-5728 | Request An Appointment

Contact Applebaum Accident Group today. We’ll connect you to the right attorney who will take your case, and you, seriously.

Alabama Car Accident Insurance FAQs

What happens if my car is worth less than my loan?

Standard auto insurance only covers your car’s actual cash value, not what you still owe on the loan. That’s where GAP insurance steps in. Without it, you could be left with thousands in unpaid loan balance after a total loss.

Can I change my insurance coverage in the middle of a policy term?

Yes, you can modify your coverage at any time, but those changes won’t apply retroactively. If you’re underinsured and an accident already happened, it’s too late to fix it. If you haven’t had an accident yet, don’t wait, update your policy before your next drive.

What if the other driver was drunk, but I still get blamed?

Unfortunately, the 1% fault rule doesn’t make exceptions for drunk drivers. If you’re found even slightly at fault, your entire claim could be denied. That’s why documentation and legal guidance are critical, every detail counts when the system is this unforgiving.

Can the rental company bill me weeks later?

Yes. Some drivers are surprised with a damage bill long after they return the car. Photos at pickup and drop-off, plus copies of your signed inspection report, can save you from unfair charges.

I don’t have UM coverage, what now?

Without uninsured motorist coverage, you may have to sue the at-fault driver directly, which can be a dead end if they have no assets. An attorney can help you identify any other possible policies or liable parties.