Yes, in Florida, medical providers and insurers can take part of your car accident settlement through medical liens. But you can reduce or eliminate what you owe with legal strategies like lien disputes, negotiations, and smart documentation. Here’s how to protect your payout.

Medical liens can take a significant chunk of your payout, unless you know how to protect yourself. In this article, we’ll show you how to keep more of your money.

What Is a Medical Lien, and Why It Can Take a Chunk of Your Settlement

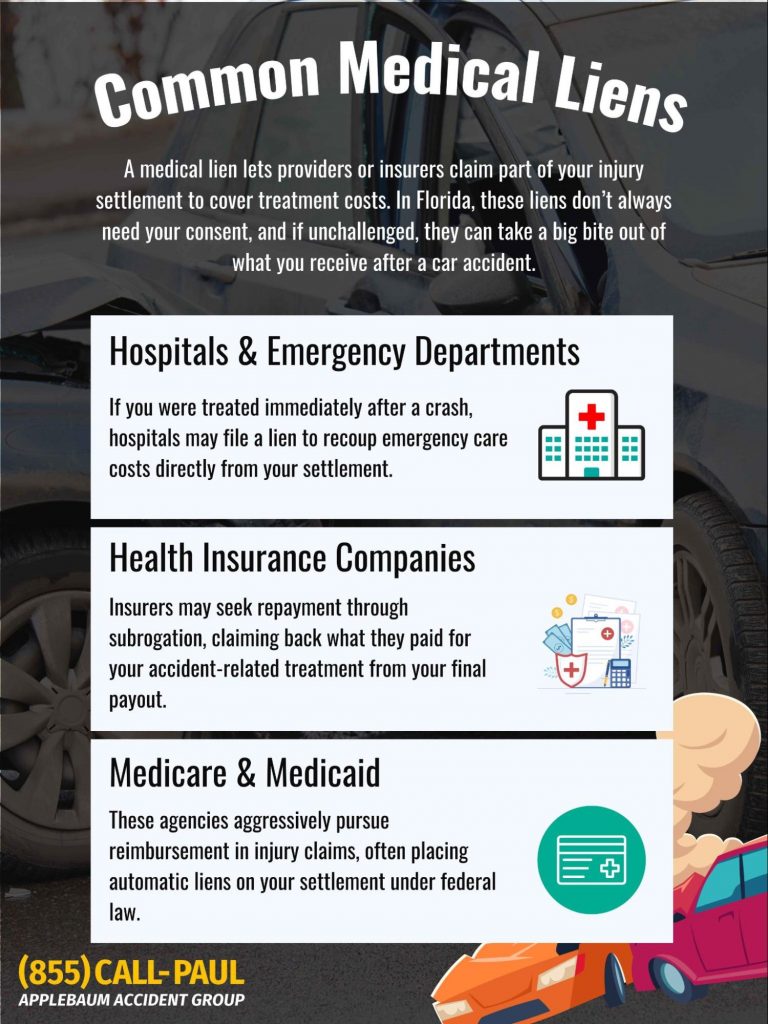

A medical lien is a legal claim placed against your injury settlement by a medical provider, health insurer, or government agency like Medicare or Medicaid.

If someone covers your treatment after a car accident, whether it’s a hospital, your health insurance company, or a chiropractor, they may file a lien to get reimbursed directly from your settlement.

Florida’s personal injury system allows this as a way to ensure medical providers get paid. But here’s the catch: lien amounts aren’t always accurate, and not every claim is valid. This is why patients are often shocked to learn how much of their personal injury settlement is at risk.

One of the most widespread misconceptions is: “I never signed anything, so they can’t take my money.” Unfortunately, liens don’t always require your signature. If a provider treated you and believes your car accident settlement will cover their costs, they can assert a claim.

Types of lienholders you may encounter include:

- Hospitals and emergency departments (especially if you went straight from the crash site)

- Health insurance companies who covered your treatment under subrogation clauses

- Government programs like Medicaid and Medicare, which aggressively seek reimbursement in personal injury cases

Each of these groups operates under different legal standards, but they all have one thing in common, they’re coming after your settlement funds.

Do I Have to Pay Medical Bills from My Settlement in Florida?

Yes, Florida law allows valid medical liens to be deducted from your personal injury claim settlement. However, this only applies to bills directly tied to your accident-related treatment.

Here’s what you don’t have to pay for:

- Services unrelated to the accident

- Duplicate or inflated charges

- Late-filed claims that violate Florida lien statutes

Too many accident victims assume all medical bills are non-negotiable, but that’s not true. Every lien should be reviewed, item by item. And any charge that doesn’t meet the legal requirements can often be reduced or removed entirely.

Florida’s Settlement Distribution Order

If you’re wondering where your money goes after a case is resolved, here’s how payouts typically work:

- Attorney fees – Your lawyer receives payment first (usually a percentage under a contingency agreement).

- Valid lienholders – Hospitals, health insurers, or government programs that legally filed a lien.

- You, the claimant – Whatever is left comes to you.

This order explains why some people walk away from a settlement with far less than expected, or, in some cases, nothing at all.

Can Insurance Take Part of My Settlement in Florida? Yes, But You Can Fight It

How Insurers Use Subrogation to Claim Your Funds

Most people don’t realize that their health insurance company may have a built-in right to reimbursement. This is called a subrogation clause, and it’s buried deep in most insurance contracts. If your insurer paid for your ER visit, imaging, or surgery, they’ll want that money back from your settlement.

But there’s a safeguard: under Florida law, those rights are not absolute.

A subrogation clause may be unenforceable if:

- The insurer failed to send required notice within 30 days of your intent to settle

- The lien is for treatment not related to the accident

- The clause violates Florida’s statutory limits or ERISA provisions

Even experienced patients miss this step. That’s why reviewing your insurance policy and timelines with a qualified attorney can make the difference between keeping your payout or watching it disappear.

“They Took My Whole Payout, Is That Legal?”

A client once came to us completely blindsided. She’d received a settlement offer that seemed fair, but when all was said and done, nearly every dollar was gone, between attorney fees and a massive hospital lien. Her key mistake? She didn’t question the lien before accepting the settlement.

This story reflects a common trap: settling before validating or disputing medical liens. Once a check is cut and the agreement is signed, your ability to fight back becomes limited.

Lesson learned: Never assume a lien is valid just because it exists. Have it reviewed early, and take proactive steps to negotiate it down or dispute it before finalizing your personal injury settlement.

How to Dispute or Reduce Medical Liens in Florida

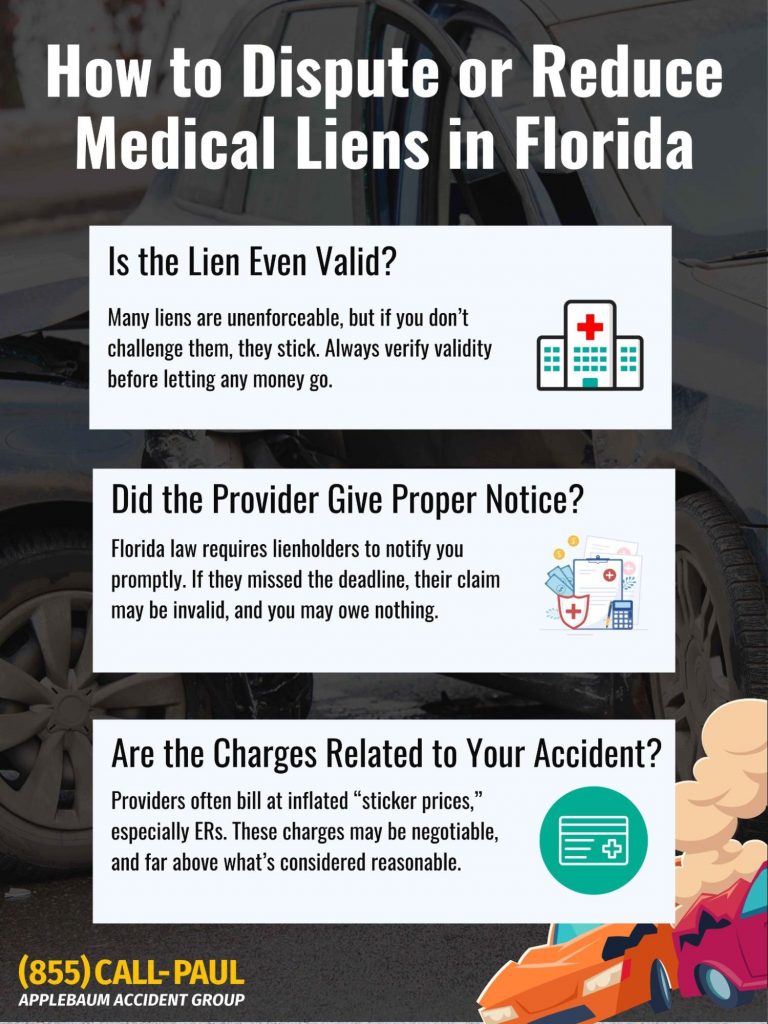

Start with Verification: Is the Lien Even Valid?

Before you start writing checks or accepting deductions, stop and verify: is the lien even enforceable? Many lien claims are invalid, but unless you challenge them, they stand.

Here’s what to check:

- Did the provider give proper notice? Florida law requires lienholders to send timely notice of their intent to recover costs. If they missed that deadline, the lien may be void.

- Are the charges directly related to your accident? Providers sometimes bill for pre-existing conditions or unrelated treatment. You’re not responsible for medical care outside your personal injury case.

- Are the rates inflated? Hospitals often charge uninsured “sticker rates,” which can be dramatically higher than negotiated insurance rates. This is especially common with emergency care and can lead to liens that are thousands more than what’s reasonable.

A simple itemized bill review, preferably with a professional, can reveal overbilling, duplicate charges, and unrelated treatment. Never assume the numbers are accurate.

How to Challenge Excessive or Unrelated Medical Charges

If something doesn’t add up, challenge it. This isn’t just allowed, it’s expected.

- Request a detailed itemized bill. Go line by line and cross-reference with your records. Look out for duplicate treatments, billing for canceled appointments, or unrelated procedures.

- Ask for a charity care review. Most Florida hospitals offer financial hardship programs. If your income qualifies, they may forgive a portion, or all, of the bill. That can drastically reduce the lien amount.

- Use hardship as leverage. When lienholders know there’s a real risk they won’t recover full payment, they may accept a reduced lump-sum settlement.

Florida Law Is on Your Side

Florida statutes provide real protection if you know how to use them:

- The 30-Day Rule: If a lienholder doesn’t respond to your notice of intent to claim damages within 30 days, they may forfeit their right to reimbursement.

- Caps After Settlement: Once a case is settled, providers cannot add new charges or increase the lien amount. Any last-minute “adjustments” are illegal.

- Comparative Fault Reductions: If you’re found partially at fault (say 30%), lienholders are only entitled to that same percentage of their claimed amount. Your liability is limited by your share of fault.

These legal defenses aren’t automatic, you have to raise them. But when applied correctly, they can significantly reduce what you owe.

Smart Strategies to Protect Your Settlement

Timing Is Everything: Why Early Action Beats Last-Minute Panic

One of the most effective ways to protect your personal injury settlement is to start early. Don’t wait until you’re staring at a settlement check to start questioning liens.

Lien discussions should begin as soon as treatment starts. Why? Because the earlier you engage with medical providers, the more control you have over the negotiation. Many victims make the mistake of delaying treatment because they’re afraid of the bills. But that delay can weaken your position later, especially if lienholders argue your injuries worsened due to lack of care.

The clock starts ticking the day you receive care. The sooner you act, the stronger your hand in dispute or negotiation.

Pro Tips from Attorneys Who’ve Handled 100s of Cases

Skilled personal injury attorneys use proven tactics to lower or eliminate lien claims:

- Submit financial hardship documentation. Pay stubs, medical debt, or lack of insurance can be compelling negotiation tools.

- Offer lump-sum settlements. A single, immediate payment is often more attractive to providers than drawn-out repayment or collection efforts.

- Get an EMC evaluation, even if it’s after 14 days. Florida’s Personal Injury Protection (PIP) law requires that a provider diagnose you with an Emergency Medical Condition to access full PIP benefits. While the “14-day rule” applies to initial treatment, an EMC evaluation, even later, can support higher recovery and a stronger lien dispute.

Avoiding Common Mistakes That Cost Victims Their Settlements

5 Medical Lien Mistakes to Avoid

- Not reading your health insurance policy: Many policies contain reimbursement clauses hidden in dense legal language. Know what you agreed to.

- Ignoring hospital bills because “insurance paid it”: Just because your insurer paid doesn’t mean the provider won’t seek more from your settlement.

- Assuming your lawyer will automatically fight the lien: Some attorneys prioritize closing the case quickly over fighting for lien reductions, ask questions and get updates.

- Settling before verifying lien amounts: Once you sign off on the settlement, your leverage disappears. Verify all lien claims beforehand.

- Forgetting independent ER doctors can file separate liens: Emergency room physicians often bill separately from the hospital itself, creating surprise liens clients never expect.

When to Get Help (And Who to Call)

Why a Florida Personal Injury Attorney Makes All the Difference

Medical liens are a minefield, especially in Florida where health insurance, PIP laws, and ERISA regulations all collide. The right attorney will know how to:

- Spot illegal or excessive charges

- Use legal statutes and case law to negotiate reductions

- Challenge liens based on timing, validity, and hardship

Attorneys with experience in personal injury cases regularly recover more by knowing which lienholders are flexible, and which fight to the end. If you try to handle this alone, you may leave thousands on the table.

Not Sure Who to Trust? We’ll Connect You.

At Applebaum Accident Group, we’ve seen too many victims lose their hard-won compensation to unchecked lien claims. That’s why we work differently. We don’t just refer you to any attorney, we connect you with professionals who understand how Florida’s lien laws really work, and who take your financial recovery as seriously as your physical recovery.

Whether you’re staring down a hospital lien, negotiating with Medicare, or confused about your rights, we’ll guide you to the right legal and medical resources. Our network isn’t just qualified, it’s invested in your outcome.

Take the First Step to Protect Your Settlement

Applebaum Accident Group connects you with trusted attorneys who understand what your case is worth, and how to make sure you don’t settle for less.

📞 855-225-5728 | Request Your Free Consultation Now

With Applebaum Accident Group, you gain access to Florida’s top legal and medical networks, without the stress or confusion. We help you move forward with confidence, clarity, and the support you need.