To file a PIP claim in Florida, report the accident, seek medical care within 14 days, notify your insurer, submit medical and wage documentation, and follow up regularly. PIP covers up to $10K in medical/wage losses, regardless of fault, but strict timelines and documentation are key.

Many drivers are unsure what PIP covers, how to file, and whether they’ll owe money out-of-pocket. This guide walks you through every step of filing a PIP claim, clarifies what you’re entitled to, and tackles common fears like low settlement offers or unpaid medical bills.

What Is PIP and Why Does It Matter in Florida

Florida is a no-fault state, meaning that if you’re injured in a car accident, your own auto insurance pays for your medical treatment and lost wages, regardless of who caused the crash.

This system is designed to reduce legal disputes and speed up access to care, but it also creates a lot of confusion around what you’re really entitled to.

At the center of this system is Personal Injury Protection, or PIP. Every driver in Florida is required to carry a minimum of $10,000 in PIP coverage as part of their auto insurance policy. This coverage kicks in immediately after a traffic accident and helps cover medical expenses and lost wages, again, whether or not you caused the crash.

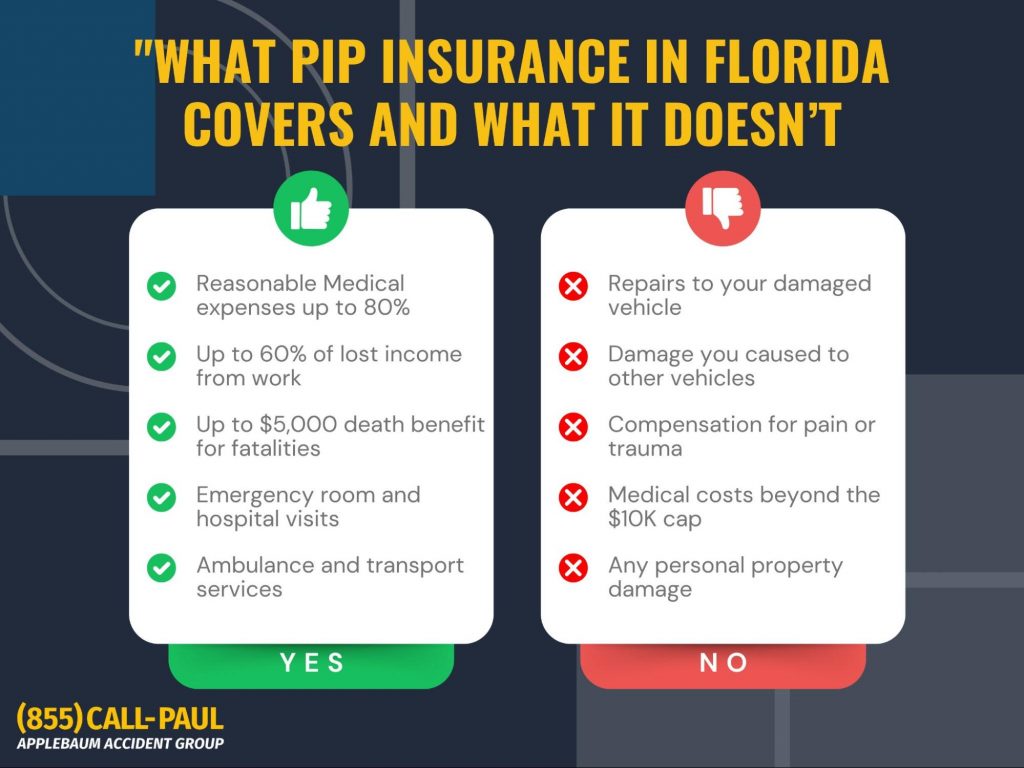

Here’s what PIP typically pays for:

- 80% of reasonable medical expenses (doctor visits, diagnostics, rehab, etc.)

- 60% of lost wages

- Up to $5,000 in death benefits if the accident results in a fatality

However, PIP does not cover:

- Pain and suffering

- Vehicle damage

- Anything beyond the $10,000 cap, unless an Emergency Medical Condition (EMC) is diagnosed

The problem? Many accident victims find out too late that $10,000 doesn’t go far, especially when ER visits alone can reach $30,000. And if you don’t follow the rules, like seeking treatment within 14 days, you could lose access to these benefits entirely.

Step-by-Step Guide to Filing a PIP Claim in Florida

Step 1 – Report the Accident Immediately

The moment you’re in a crash, the first priority is safety. Get off the road if possible and call the police, even for minor fender-benders.

A police report becomes a critical piece of documentation when dealing with your insurance company.

Next, notify your insurance provider right away. While Florida law gives you 14 days to seek medical care, most insurance policies require prompt reporting of any incident. This sets the claim process in motion and ensures your benefits aren’t delayed or denied.

Step 2 – Seek Medical Care Within 14 Days

To qualify for PIP coverage, you must get treatment from an approved medical provider, which includes medical doctors, hospitals, emergency clinics, and some chiropractors. If your injuries are serious enough, you may also need an EMC (Emergency Medical Condition) evaluation. This diagnosis allows access to the full $10,000 in PIP benefits, rather than being capped at $2,500.

What if you miss the 14-day window?

Unfortunately, PIP benefits are forfeited if you don’t seek medical attention within 14 days. This deadline is firm.

Even if your injuries seem minor at first, don’t wait, many symptoms like whiplash or soft tissue damage show up days later.

Step 3 – Submit Medical Bills and Wage Loss Documentation

You’ll need to provide proof of your medical expenses and lost income. That includes:

- All medical invoices, even if treatment is ongoing

- Employer verification of time missed at work

- Logs of mileage to appointments, which may be reimbursed

PIP will reimburse 60% of lost wages, but every dollar matters, especially when bills pile up fast. Just be strategic: using too much of your PIP for wage replacement could limit what’s available for continued care.

One key issue people face is confusion around manual therapy versus massage. These services may sound alike, but insurance companies treat them differently.

Step 4 – Monitor the Claim and Stay Organized

Staying on top of your claim is half the battle. Keep detailed records of:

- Every conversation with your insurance adjuster

- All medical visits and treatments

- Letters, emails, or requests for documentation

It’s also smart to track your benefit usage, especially if your injuries require ongoing care. Many people accept early BI (bodily injury) settlements without realizing they’ll need long-term treatment, or that these offers are often insultingly low.

We’ve seen it too often: victims walk away with a fraction of what they’re owed, simply because they didn’t have the right team guiding them.

That’s where Applebaum Accident Group comes in. We connect you with experienced professionals who know how to protect your legal rights and get you the compensation you truly deserve.

What Are You Entitled to After a Florida Car Accident?

After a car accident in Florida, your first layer of financial protection is your Personal Injury Protection (PIP) policy. As required by state law, PIP pays:

- 80% of your medical expenses, up to the policy limit

- 60% of your lost wages

- $5,000 in death benefits, if applicable

But that $10,000 cap can feel more like a speed bump than a safety net, especially if you’ve already racked up ER charges, imaging scans, follow-up visits, and rehab within the first few days. What happens if your medical bills exceed your PIP limits?

If your injuries qualify as serious under Florida law, you can step outside the no-fault system and file a bodily injury claim against the at-fault driver. Serious injuries include:

- Significant or permanent loss of a bodily function

- Permanent injury within a reasonable degree of medical probability

- Significant and permanent scarring or disfigurement

In those cases, you may be eligible to pursue compensation for pain and suffering, emotional distress, and future medical expenses through a personal injury lawsuit. But keep in mind: not every driver in Florida carries bodily injury (BI) liability coverage, because it’s not legally required.

When BI coverage is available, your attorney may pursue a settlement. If it’s not, or if the driver is underinsured, you may have to rely on your own Uninsured/Underinsured Motorist (UM/UIM) coverage to bridge the gap.

Rules & Realities of PIP Insurance in Florida

How PIP Interacts with Other Coverages

If you’re new to all this, terms like PIP, BI, and UM can blur together fast. Here’s a breakdown of how they work together:

- PIP (Personal Injury Protection): Pays for your medical bills and lost wages, no matter who caused the accident.

- BI (Bodily Injury Liability): Pays others if you cause a serious injury, only if the policy includes this (not mandatory in Florida).

- UM/UIM (Uninsured or Underinsured Motorist): Kicks in when the at-fault driver has no BI coverage or not enough to cover your damages.

Yes, you can claim under multiple policies. For example, if you’re hit by a driver with no BI, and your PIP is exhausted, you may still file under your UM policy, each injured person has an individual claim path.

Understanding Balance Billing and Hospital Charges

Florida law prohibits balance billing for auto accident care under PIP. That means hospitals can’t bill you beyond what your PIP and insurance policy allow, even if they try to intimidate you into paying the difference.

If you receive a statement showing a massive balance after your PIP has paid its portion, don’t panic. Attorneys often negotiate medical bill reductions, especially when hospital charges reach $30,000 or more, a figure that’s not uncommon after a full trauma workup.

When the Other Driver Has No Insurance (Or Low Limits)

This is a huge issue in Florida. Drivers aren’t required to carry bodily injury liability insurance, so many don’t. If you’re seriously hurt and the other driver can’t pay, you’re left with three possible options:

- Use up your PIP benefits

- File against your UM/UIM policy, if you have one

- Pursue a personal injury lawsuit

But here’s the hard truth: even if you win a lawsuit, you may never collect a dime if the driver is insolvent.

That’s why we always recommend adding UM coverage to your policy. It’s often the only realistic safety net when you’re up against an underinsured or uninsured motorist.

Common Mistakes That Derail Florida PIP Claims

Even the most deserving accident victims can jeopardize their claims by missing small, but critical, steps. Watch out for these pitfalls:

- Failing to seek treatment within 14 days

- Settling your BI claim before you’re done with treatment

- Assuming the insurance adjuster is working in your best interest

- Forgetting to track mileage or lost income

And then there’s the fear that hangs over everything: “Am I going to end up owing $30,000?”

That’s a very real risk if you don’t manage your claim carefully.

If your medical bills exceed your PIP coverage, and there’s no BI or UM/UIM support, you could be facing massive out-of-pocket debt. But with the right guidance, there are options, bill reductions, Medicaid backup, structured settlements, that can ease the financial burden.

When to File Your Personal Injury Lawsuit

Florida’s no-fault insurance system means most minor car accidents are handled through PIP, not the courtroom. But if your injuries cross a certain threshold, you may step outside the no-fault system and file a personal injury lawsuit against the at-fault driver.

Here’s when that’s possible:

You must have sustained a serious injury, such as:

- Permanent loss of a vital bodily function

- Permanent injury with a high degree of medical certainty

- Permanent scarring or disfigurement

- Death (in which case, survivors may file for death benefits or a wrongful death claim)

To prove this, you’ll need detailed medical records, consistent follow-up treatment, and in many cases, testimony from doctors or specialists. This is where EMC evaluations (Emergency Medical Condition) and consistent rehab logs become pivotal.

Timeline of a Personal Injury Lawsuit

- Weeks 1–4: Initial consultation and case review

- Months 1–6: Investigation, treatment, demand letters sent

- Months 6–18: Negotiation or litigation (if needed)

- Month 18+: Trial phase if no settlement is reached

Take the First Step Toward the Settlement You Deserve

Applebaum Accident Group connects you with trusted attorneys who understand what your case is worth, and how to make sure you don’t settle for less.

📞 855-225-5728 | Request Your Free Consultation Now

With Applebaum Accident Group, you gain access to Florida’s top legal and medical networks, without the stress or confusion. We help you move forward with confidence, clarity, and the support you need.