Yes, PIP (Personal Injury Protection) is considered a collateral source in Florida but with specific legal exceptions. Unlike other collateral sources, PIP may be subject to subrogation or setoff depending on the case specifics and insurance agreements.

In this article, we will break down:

- What it means for PIP to be a collateral source in Florida

- How subrogation applies

- What PIP insurance actually covers

- How much your attorney might take from your settlement

- Florida’s collateral source rule

- Legislative changes

- How to navigate these issues with confidence

If you’ve been injured in a car accident in Florida, or you’re simply trying to understand how PIP impacts your potential claim, this guide will provide clarity.

What Is a Collateral Source in Florida?

In Florida, a collateral source refers to any payment a plaintiff receives from a third party, such as an insurance company, that is independent of the defendant’s responsibility for the injury. These are funds meant to compensate the injured party but are not directly provided by the party at fault.

The purpose of recognizing collateral sources is to ensure that a defendant’s liability isn’t reduced simply because the plaintiff had the foresight to secure insurance.

Florida law protects the plaintiff’s right to recover full damages from the defendant, regardless of any other compensation received.

Examples of collateral sources include health insurance payments, life insurance proceeds, and auto accident insurance settlements. However, there’s a key nuance: government programs like Medicare and Medicaid are not considered collateral sources in Florida. This distinction plays a significant role in how courts address compensation and offsets.

Is PIP a Collateral Source in Florida?

The answer is yes, Personal Injury Protection (PIP) is classified as a collateral source under Florida law. But it’s distinct from other sources because of how it is applied in legal proceedings.

- Setoff and Subrogation: Unlike some collateral sources that are completely ignored in damage awards, PIP benefits may be subject to setoff (reducing court-awarded damages by the amount already paid) or subrogation (insurers seeking reimbursement from the responsible party).

- Impact of 2023 Tort Reform: The Florida legislature’s recent reforms have altered how insurance evidence, including PIP, can be used in court. Previously barred from being introduced to a jury, insurance payments may now be admissible to reflect the true economic impact.

- Court Handling: Setoffs for PIP payments are applied by the judge after the verdict, not by the jury during deliberations. This ensures that plaintiffs don’t recover twice for the same expenses.

- Waiver Clarified: Can PIP be waived? The answer is no. Florida law mandates that every driver carries PIP coverage. This requirement is part of the state’s no-fault insurance system, designed to ensure that injured parties receive immediate medical care, regardless of who caused the accident.

PIP Insurance Coverage in Florida

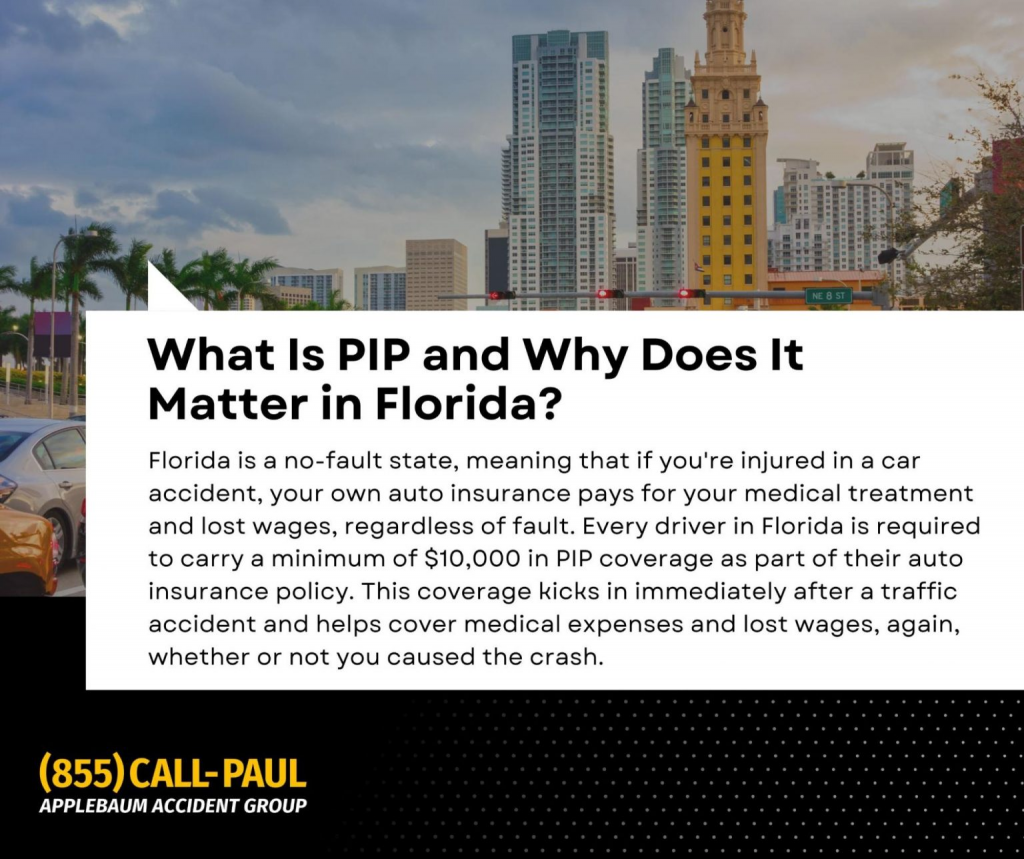

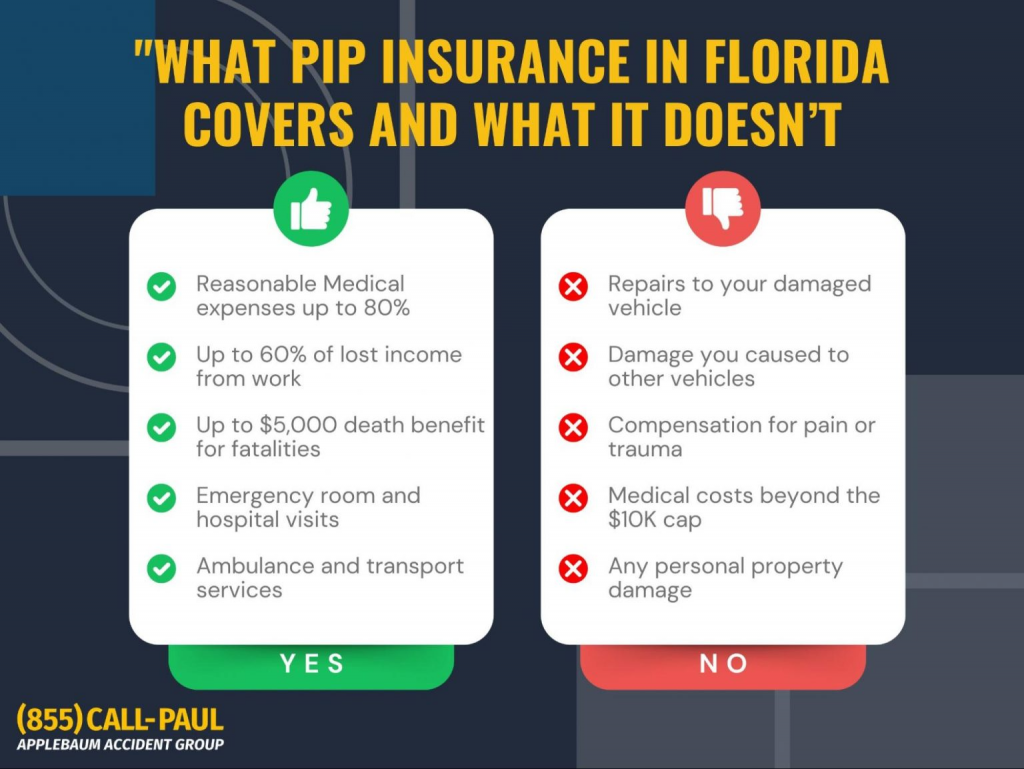

Personal Injury Protection, or PIP insurance, is a cornerstone of Florida’s no-fault auto insurance system. Its main function is to provide swift coverage for medical expenses and lost wages after a car accident, without requiring proof of fault.

Coverage Basics:

- PIP offers up to $10,000 in benefits for medical bills and lost wages resulting from a car accident.

- To access these benefits, the injured person must seek medical treatment within 14 days of the accident. This is a strict legal deadline; missing it typically results in forfeiture of PIP benefits.

- An Emergency Medical Condition (EMC) diagnosis is required to unlock the full $10,000 of PIP benefits. Without this, benefits may be limited to $2,500.

Addressing a Common Worry: Many people fear, “Will I get the full PIP benefits?” The answer depends largely on whether a qualified medical provider formally diagnoses an EMC.

Is PIP Subrogatable in Florida?

The answer is sometimes. Subrogation refers to an insurer’s right to reclaim payments it made to the insured by pursuing recovery from the at-fault party.

Subrogation Basics:

- In Florida, PIP insurers may seek reimbursement from liable third parties under certain conditions, especially in cases involving serious injuries where the injured party steps outside the no-fault system to sue the at-fault driver.

- Coordination of benefits adds another layer of complexity, when health insurance also pays for accident-related care, the sequence of billing and reimbursement can be confusing.

A Practical Example: If you settle with the at-fault driver without notifying your PIP insurer, you could face subrogation demands later. Insurers may attempt to recoup PIP benefits paid, complicating your financial recovery.

Many people are caught off guard by unexpected subrogation claims, especially after settling with the at-fault party. This underscores the importance of consulting with knowledgeable legal counsel before agreeing to any settlement.

Does Florida Allow Subrogation Generally?

Yes, Florida does allow subrogation, but how it applies depends on the type of insurance involved.

- PIP subrogation is often limited but still possible. While insurers may seek reimbursement in some scenarios, Florida law restricts these rights to prevent unfair financial strain on injury victims.

- Health insurance plans, especially those governed by federal ERISA rules, often retain broad subrogation rights. This means your health insurer could seek to recover amounts it paid out for your accident-related medical care.

- Workers’ compensation is also considered a collateral source, but it operates under its own distinct set of subrogation rules.

How Much Will My Lawyer Take

The general rule for personal injury attorneys in Florida is to charge a contingency fee of 33.3% to 40% of the total settlement amount. This ensures that your lawyer only gets paid if you win your case.

However, when it comes to PIP disputes, some attorneys charge hourly rates or flat fees, especially for tasks like disputing denied PIP benefits or addressing subrogation claims. Contrary to popular belief, not all PIP attorneys work on a contingency basis.

A unique issue that can complicate matters is that some medical providers require patients to assign their PIP benefits directly to them. This can lead to legal disputes if the insurer refuses to pay or delays payment.

Here’s a practical tip: Always clarify your attorney’s fee structure before hiring them for your PIP or personal injury case. Knowing exactly how much will be deducted from your recovery can prevent surprises later.

PIP Interaction with Other Insurances and Lawsuits

PIP is typically considered the primary insurance for accident-related medical expenses, meaning it pays before other coverages like health insurance. However, this coordination of benefits can sometimes lead to reimbursement issues if other insurers also contribute.

Certain medical providers may refuse to treat patients relying solely on PIP because of delayed or capped payments, pushing injured parties to pay out-of-pocket initially, a scenario that adds unnecessary financial stress.

Another key point is the rule against double recovery.

While Florida’s collateral source rule prevents plaintiffs from being compensated twice for the same economic damages, it does not restrict recovery of non-economic damages like pain and suffering. These damages remain available even when PIP or other insurance covers some of the economic losses.

Legislative Changes And Florida’s 2023 Tort Reform

The 2023 Florida Tort Reform, specifically House Bill 837, introduced significant modifications to how PIP and collateral source payments are treated in court.

The key change now allows for the introduction of insurance payments as evidence in certain personal injury cases.

Previously, juries were barred from knowing about collateral source payments, including PIP, to avoid unfair prejudice. This shift means that defense attorneys may present evidence of these payments to reduce the amount awarded by juries.

The impact is clear: it could result in lower jury verdicts, especially in cases where the injured party has already received compensation through PIP or other insurance benefits.

The practical effect is that plaintiffs might recover less than they expect, unless they and their legal counsel understand how to navigate these new evidentiary rules. This makes it even more vital to work with professionals who are familiar with the nuances of Florida’s evolving legal landscape.

Expert Tips for Navigating PIP and Collateral Source Issues

Successfully managing the complexities of PIP and collateral sources in Florida requires a strategic approach:

- Document everything: From the moment of the accident, keep meticulous records of your medical treatment, correspondence with insurers, and all claim-related documents. This ensures you have the necessary proof for any disputes over PIP payments or subrogation.

- Consult a PIP-savvy attorney: An attorney with experience handling PIP issues can help you avoid common pitfalls, such as missing the EMC requirement or mishandling subrogation demands. They can also guide you through the intricacies of the 2023 tort reform changes.

- Be cautious of quick settlements: Insurers may offer fast settlements that appear attractive but often come with strings attached, such as waiving your right to pursue additional claims. Always review settlement offers carefully, preferably with legal counsel, to ensure your long-term interests are protected.

Get the Right Help Navigating Florida’s PIP and Collateral Source Complexities

If you’re here, you’re likely asking, “Is PIP a collateral source in Florida?”, but what you’re really looking for is clarity on how to protect your settlement, avoid costly subrogation traps, and maximize what you take home after an accident. These are complex issues that can cost you thousands without the right guidance.

That’s exactly where Applebaum Accident Group can step in.

Here’s How We Can Help:

- Connect You with the Right Attorney: Not just any personal injury lawyer, but one who is seasoned in Florida’s evolving PIP and collateral source laws, including navigating subrogation risks and maximizing settlements.

- Streamline Your Medical and Legal Path: Through our trusted network, we ensure that you’re seen by qualified medical providers quickly and that your legal case moves forward efficiently, without getting tangled in insurance technicalities.

- Protect You From Subrogation Pitfalls: Our connections and knowledge ensure that your rights are safeguarded from hidden subrogation claims that can reduce your settlement after the fact.

What Can Happen If You Take Action?

With Applebaum Accident Group by your side, you’ll move forward with confidence knowing that you’re protected from insurance tactics that reduce your compensation. You’ll have the right attorney fighting for your rights and the right medical team helping you recover. No more sleepless nights wondering if your claim is handled properly or if you’ve missed a key deadline.

Your recovery, both physical and financial, starts here.

📞 855-225-5728 | Request An Appointment