In Alabama, the at-fault driver pays for collision damage. Because Alabama follows a “fault” system and strict contributory negligence laws, if you’re even 1% at fault, you may recover nothing. This makes who’s blamed, and how, crucial for your case.

If you’ve been in a car accident in Alabama, knowing who pays for the damage isn’t always simple. Alabama isn’t a no-fault state, it follows a strict “at-fault” system. That means the driver who caused the crash is financially responsible.

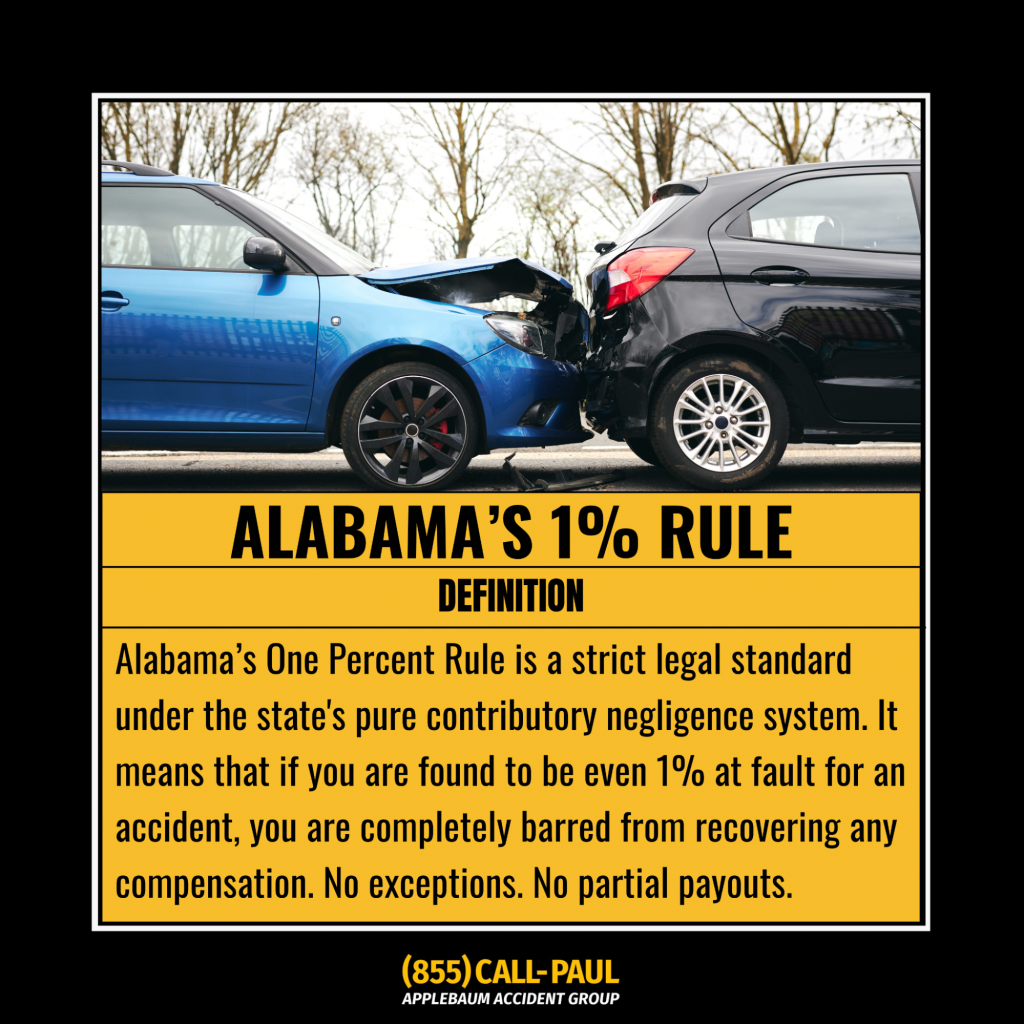

But under Alabama’s harsh contributory negligence law, if you’re even 1% at fault, you could lose your right to compensation entirely.

This article unpacks:

- How fault is determined

- What insurance actually pays

- What happens if you’re uninsured or partially blamed

- How to protect yourself when navigating claims and arbitration delays

Still unsure what all this means for your situation? Applebaum Accident Group connects you with top attorneys who understand Alabama’s complex fault laws and can help you avoid costly missteps. For the full breakdown, including consequences, workarounds, and protections, keep reading.

Is Alabama a No-Fault State?

No, Alabama is a fault-based state. That means the insurance of the person who caused the crash is expected to cover the costs, whether it’s for vehicle repairs, medical expenses, or other damages. But what makes Alabama distinct is how blame is handled.

The state follows a strict contributory negligence doctrine. That means if you are found even 1% responsible for the accident, you could be denied any compensation. This is often misunderstood until it’s too late, and it’s one reason why insurance companies in Alabama are quick to shift partial blame when reviewing claims.

If you’re confident the accident wasn’t your fault, that’s good. But proving it to an insurer or in court is another matter entirely.

Who Pays for Collision Damage in Alabama?

Typically, the at-fault driver’s insurance is supposed to handle collision damage. If another driver caused the crash, you’d file a third-party claim with their insurer. But there’s a catch: if the other driver lacks insurance, or their insurer refuses to pay, you’re stuck unless you’ve got your own safety net.

Here’s how that breaks down:

- If you’re at fault and don’t carry collision coverage, you’ll have to pay for the repairs yourself.

- If you lease or finance your car, your lender will likely require both collision and comprehensive coverage.

- If the other driver is uninsured, you’ll have to rely on:

- Uninsured Motorist (UM) coverage: Pays for your damage if the at-fault party can’t.

- Medical Payments (MedPay): Optional coverage for your medical bills regardless of fault.

- Lawsuit: If no coverage exists, suing might be your only path, but recovery depends on their ability to pay.

It’s a high-stakes situation where coverage gaps mean real financial risk.

What to Do If You’re Partially Blamed

Here’s the part no one wants to hear: in Alabama, partial fault means no payout. Even if you did everything right and the other driver rear-ended you, the insurance company might claim you “stopped suddenly” or “failed to signal,” just enough to reach that 1%.

Insurers know this rule and use it. Often. If you’re being blamed even a little, act quickly:

- Get the police report and challenge inaccuracies immediately.

- Collect photo and video evidence from the scene, if possible.

- Talk to witnesses they can make or break your case.

- Push back on the fault assignment with documentation, and if needed, with legal help.

The difference between 0% and 1% fault in Alabama is the difference between getting paid and paying out.

What If You Don’t Have Collision Coverage?

Without collision coverage, you’re exposed, even if you didn’t cause the crash. You’ll only get your car repaired through insurance if:

- You’re 0% at fault and the other driver has valid insurance

- You win a lawsuit against the at-fault driver

Otherwise, you’re responsible for the repairs.

This isn’t just about car damage. Here’s what we’ve seen:

- Drivers losing job offers because their car was totaled and they had no way to get to interviews

- Credit scores dropping due to unpaid repair bills or vehicle loan defaults

- Working parents stranded without transportation in rural areas with no public transit

- College students isolated, missing class or commuting options entirely

These are the real-world ripple effects of driving without collision coverage in a state where fault and compensation leave zero room for error.

What Are Alabama’s Minimum Insurance Requirements?

Alabama law requires drivers to carry:

- Bodily Injury Liability: $25,000 per person / $50,000 per accident

- Property Damage Liability: $25,000 per accident

Beyond that, Uninsured Motorist (UM) coverage must be offered by insurers, but you can decline it in writing. Declining might save a few dollars short-term, but when the driver who hits you has no coverage, that decision could cost you thousands.

Collision and comprehensive coverage remain optional, unless your lender requires it. But if you’re not financing your vehicle, the responsibility for protecting your car from damage or theft is fully on you.

What to Do After a Collision in Alabama

Step-by-step checklist:

- Call 911 and request a police report.

- Photograph all vehicles, damage, and the scene, preferably before vehicles are moved.

- Exchange information with the other driver, including insurance and contact details.

- Get medical care, even if you feel fine. Soft-tissue injuries and back trauma often show up later.

- Inform your insurer, but don’t speculate or admit fault.

- Track every dollar, towing, lost wages, rental cars, medical costs.

- Consult a legal professional if your fault is being challenged or if there’s pushback on your claim.

Small errors, like assuming you’re in the clear or forgetting to request medical records, can lead to denied compensation under Alabama’s rigid system.

Why It’s Risky to Handle This Alone

Even smart drivers miss things after an accident. A missed witness. A poorly worded statement to an insurer. An uncorrected police report. In Alabama, the penalty for these small mistakes can be massive. Just 1% fault can leave you with 100% of the bill.

That’s where Applebaum Accident Group steps in.

We’re not a law firm, we’re the connector. But we know the legal landscape inside and out. With our help, you’ll get:

- A referral to a car accident attorney who fights back, and wins.

- Access to medical professionals who understand collision injuries and injury documentation.

- Guidance through arbitration or litigation if your insurer denies or delays payment.

You Don’t Have to Fight the Insurance Company Alone

If you’re reading this, chances are you’re dealing with some version of this nightmare: your car’s wrecked, the bills are piling up, and no one’s giving you straight answers.

That’s exactly who we’re here for:

- You get your car repaired, or replaced.

- You get back to work.

- You stop worrying about whether you’re going to lose your case over one technicality.

Don’t wait until it’s too late. 👉Contact Applebaum Accident Group now.

📞 855-225-5728 | Request An Appointment

FAQs from Drivers in Alabama

How much are most car accident settlements in Alabama?

Moderate injuries often lead to settlements ranging from $10,000 to $50,000. Severe injuries or long-term impairments can push that number well beyond six figures.

Who is at fault in a rear-end collision?

Usually, the rear driver is blamed. But that’s not guaranteed. Insurers may argue the front driver braked too suddenly or failed to signal, just enough to trigger Alabama’s 1% rule and deny your claim.

What if the police report is wrong?

It happens more than you think. You can, and should, request a correction if there are factual errors. A single incorrect detail can jeopardize your entire case.

Can I recover lost wages from being unable to work due to no car?

If the accident wasn’t your fault and you document everything, including job offers rescinded or work you couldn’t attend, then yes. Otherwise, insurance won’t step in.