Alabama requires minimum liability coverage of 25/50/25: $25K for injury per person, $50K per accident, and $25K for property damage. But this legal minimum may leave you financially exposed, learn why and how to protect yourself.

To make informed choices, you need to know what this minimum coverage actually includes, and more importantly, what it leaves out. You also need to understand when and how you might be on the hook for expenses that your insurer won’t cover under a minimum policy.

At Applebaum Accident Group, our team is here to connect you with attorneys who understand how to navigate insurance gaps and fight for your rights after a crash.

If you want to uncover how insurance companies really operate, and how to protect yourself beyond the bare minimum, keep reading.

Alabama’s Minimum Auto Insurance Requirements

Alabama law sets a clear threshold for auto insurance coverage, but meeting the legal standard isn’t the same as having real protection.

Liability Limits (25/50/25):

- $25,000 for bodily injury to one person

- $50,000 for total bodily injury per accident

- $25,000 for property damage per accident

These limits are the bare minimum to drive legally in Alabama. Every vehicle registered in the state must be insured by a provider licensed in Alabama. If you drive without coverage or let your policy lapse, even briefly, you could face steep fines, registration suspension, or have your vehicle impounded.

What Minimum Coverage Does and Doesn’t Protect

A 25/50/25 liability policy only pays for the damage you cause to others, not yourself.

What’s Covered:

- Medical bills for other drivers or passengers

- Repairs to other people’s vehicles or property

What’s Not Covered:

- Your own medical treatment after a crash

- Repairs to your vehicle

- Legal defense if someone sues you beyond the policy limits

This is where many drivers miscalculate. They assume “liability” coverage protects them, but it doesn’t. And if you’re involved in a more serious accident? Minimum coverage might cover just a fraction of the total cost.

Hidden Risks of Minimum Coverage

These are the traps that catch drivers off guard:

- “Will this protect me in court?” Not if the judgment exceeds your limits.

- “What if the other car was a luxury vehicle?” That $25,000 property cap disappears quickly.

High-Risk Gaps Include:

- Chain-reaction accidents involving multiple cars

- Serious injury claims with prolonged hospital care

- Passenger lawsuits, even from friends or family

What Happens If You Let Coverage Lapse in Alabama

A lapse in your auto insurance, even for a month, can lead to more than just a late fee. Here’s what drivers should know:

- SR-22 Requirement: You may be required to file an SR-22 form to prove you’re insured again, which can raise your premiums.

- Registration Suspension: Alabama can suspend your vehicle registration if you’re caught driving uninsured.

- Hefty Fines: Fines can increase with each offense, and repeat lapses can make you a higher-risk driver.

- Harder to Find Good Rates: Insurers may label you high-risk, and discounts disappear once you have a gap.

Misunderstandings to Avoid:

- “Full coverage” isn’t a legal term, and doesn’t mean full protection

- Your minimum policy won’t cover rental cars unless you pay extra

- Optional Add-Ons That Actually Help:If you want protection that extends to you, not just the other driver, these are worth considering:

- Uninsured/Underinsured Motorist Coverage: Covers your injuries if hit by someone without insurance, or not enough of it.

- Medical Payments Coverage: Pays your ER bills regardless of who’s at fault, no need to wait on the other driver’s insurer.

Collision & Comprehensive Coverage

- Collision: Covers your car after a crash, even if you caused it.

- Comprehensive: Covers theft, fire, weather, or even hitting a deer.

You don’t need to over-insure, but minimum coverage leaves too much to chance.

Signs You Might Need More Than the Minimum

Not sure if your bare-bones policy really fits your life? Here are red flags:

- You have a new or high-value vehicle: Repairs can quickly exceed $25,000.

- You commute daily on busy highways: More miles = higher chance of a multi-car crash.

- You’d struggle to pay out of pocket: If you don’t have savings to handle an accident gap, more coverage is worth it.

- You lend your car to family or friends: Your policy must protect you if someone else causes a crash in your vehicle.

- You want peace of mind: Add-ons like medical payments or uninsured motorist coverage help when the unexpected happens.

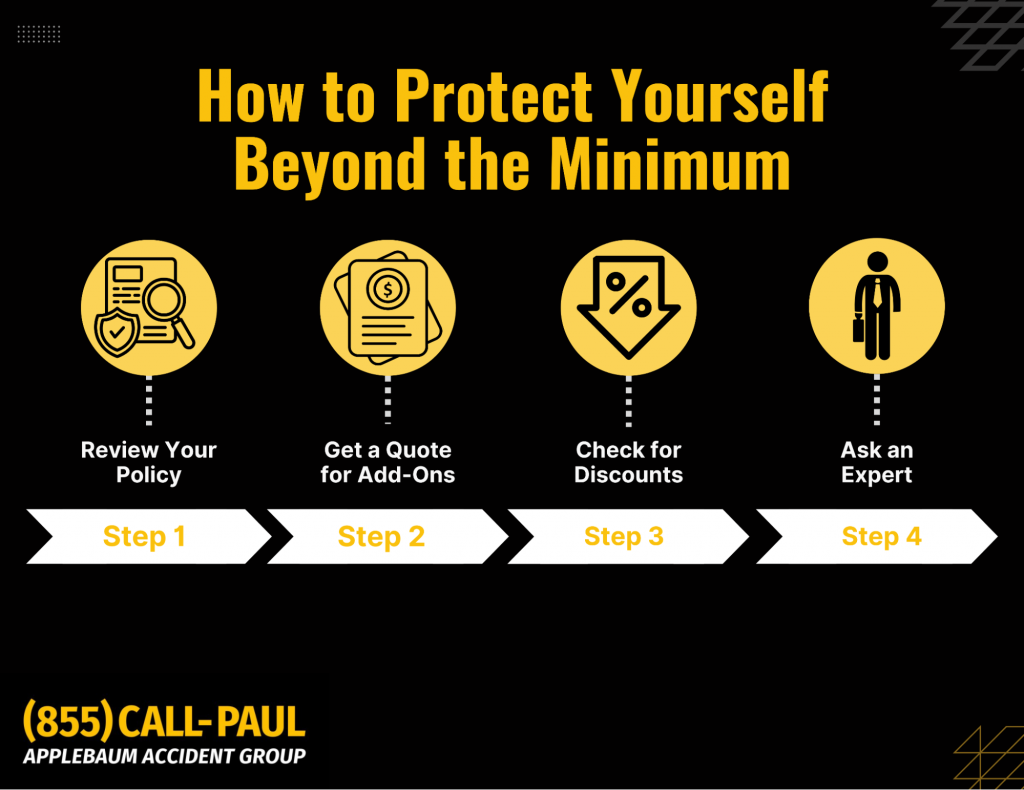

Step-by-Step: How to Protect Yourself Beyond the Minimum

Even if you’re legally compliant, true financial security takes a few extra steps. Here’s how to move beyond the bare minimum:

- Review Your Policy: Don’t assume you’re covered. Check if your limits meet your actual risk, not just legal requirements.

- Get a Quote for Add-Ons: Uninsured motorist coverage, collision, and medical payments are often more affordable than people expect, and can save you thousands in a crisis.

- Check for Discounts: Ask your insurer about bundling options, good driver incentives, and other ways to reduce premiums without sacrificing coverage.

- Ask an Expert: Still not sure? A professional can explain where you’re exposed and help you avoid nasty surprises after a crash.

Compliance vs. True Protection

Minimum insurance may satisfy Alabama law, but it won’t always satisfy your bank account after an accident. Many drivers learn the hard way that legal coverage doesn’t guarantee financial safety. One misjudgment, one distracted moment, or one unlucky crash, and you’re on the hook for medical bills, repairs, or even legal fees that far exceed your policy limits.

Taking a closer look at your insurance today is the simplest way to protect yourself tomorrow.

You Don’t Need to Face Insurance Alone

Knowing Alabama’s auto insurance laws is only half the battle. The real challenge comes when something goes wrong, and your coverage doesn’t stretch far enough. That’s where Applebaum Accident Group comes in.

If you’ve been injured in a car accident, we’ll connect you with attorneys who know how to challenge lowball offers, identify gaps in insurance, and fight for the compensation you deserve. We also help clients understand what their policy really means, so they’re not blindsided after a crash.

Whether you’re navigating your first accident or trying to make sense of an insurer’s denial, Applebaum Accident Group is here to help you take back control.

📞 855-225-5728 | Request An Appointment

Contact us today and we’ll connect you with a skilled attorney who puts your best interests first.

FAQs About Alabama Minimum Insurance

Drivers in Alabama often get caught off guard by what their policy does (and doesn’t) do. Here are quick answers:

- Can I sue an uninsured driver? Yes, but collecting money can be difficult if they don’t have assets.

- Does minimum coverage protect me in another state? Most policies adjust to meet another state’s minimum, but limits apply.

- What if I’m hit in a parking lot and the other driver flees? If you have uninsured motorist coverage, you’re protected; otherwise, you may pay out of pocket.

- Does my policy cover rental fees after an accident? Not automatically, you’ll need rental reimbursement coverage.